Analytics

Actionable Insights

Transform Mobile Intelligence into Action Items

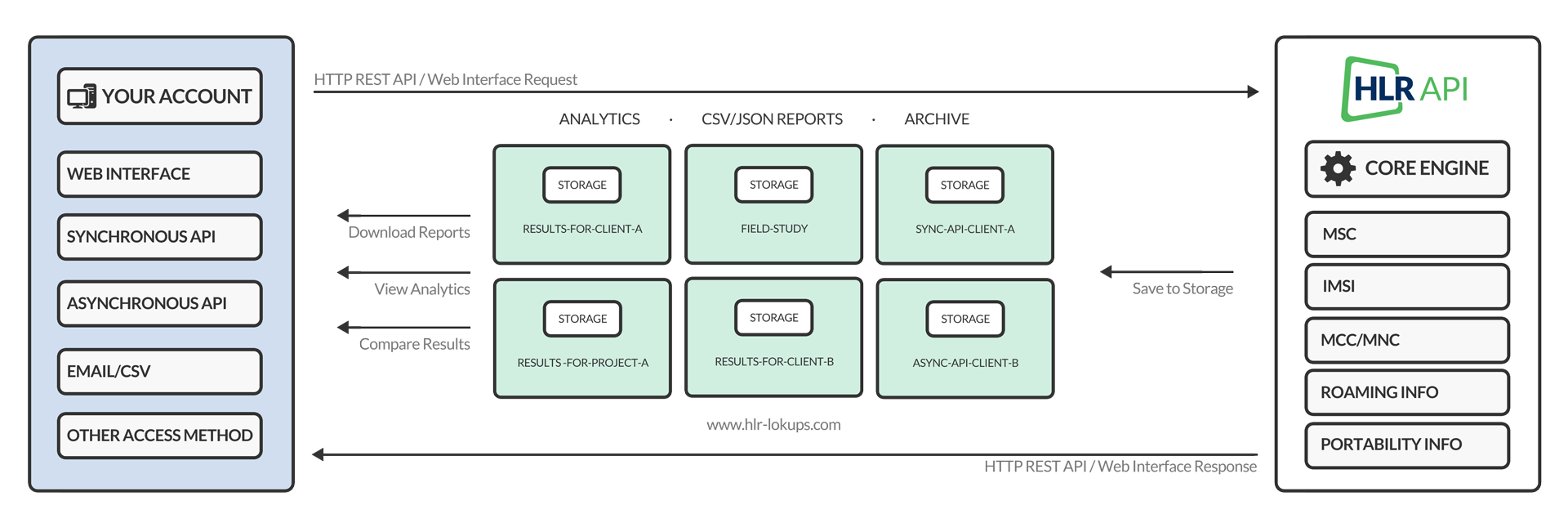

Unlock the full potential of your HLR, MNP, and NT lookup data with our enterprise-grade analytics and reporting platform. Designed for telecom professionals, VoIP providers, SMS aggregators, and mobile marketers, our comprehensive dashboard transforms raw lookup results into strategic intelligence that drives smarter decisions and maximizes operational efficiency.

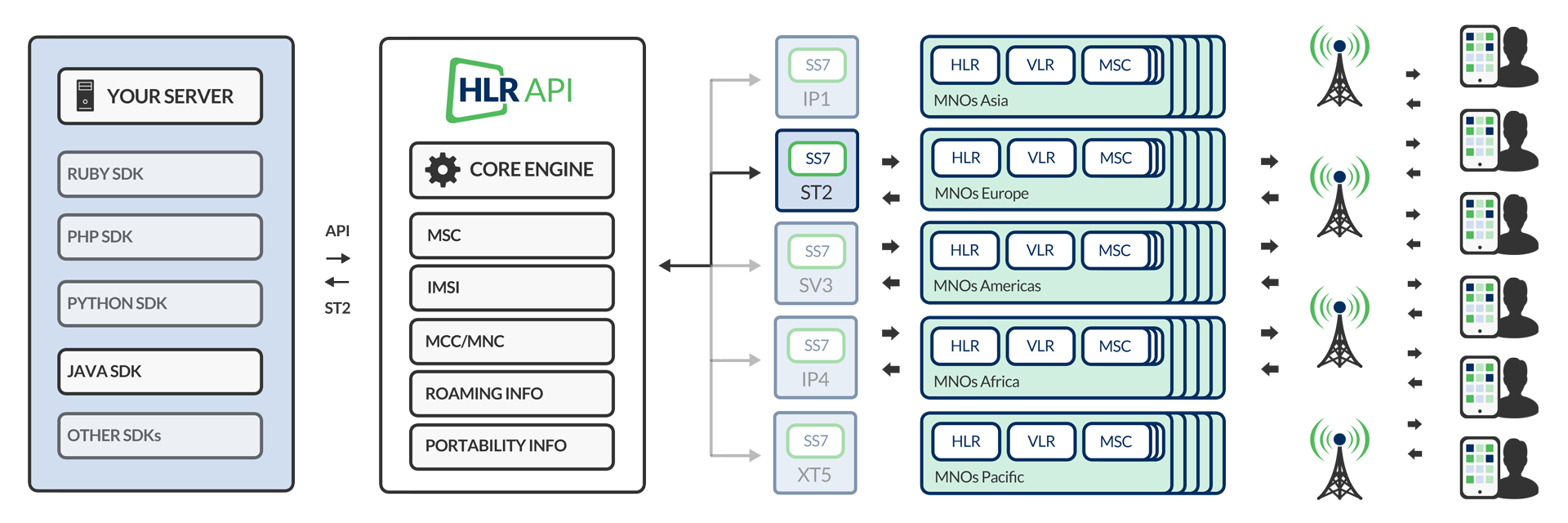

Whether you're processing hundreds or millions of lookups monthly, our platform provides real-time visibility into connectivity patterns, network distribution, subscriber behavior, and routing performance. Every lookup is automatically aggregated, analyzed, and visualized, giving you instant access to the metrics that matter most for your business.

Live Traffic Monitoring & Historical Analysis

Monitor your lookup operations in real-time with live traffic feeds, active job tracking, and instant performance metrics. Our platform captures every lookup request and response, providing continuous visibility into processing status, success rates, and network responses. Watch as your bulk jobs progress through our distributed processing engine, with live updates showing completion percentages, throughput rates, and estimated time remaining.

Beyond real-time monitoring, our historical analytics engine stores and indexes all lookup data for comprehensive retrospective analysis. Compare performance across different time periods, identify trends in subscriber connectivity, track seasonal variations in mobile network behavior, and measure the impact of routing changes on delivery success rates. Generate custom date-range reports to analyze specific campaigns, client projects, or operational periods with surgical precision.

Multi-Dimensional Data Intelligence

Our analytics engine processes lookup results across multiple dimensions, extracting valuable insights that would be impossible to identify manually. For HLR lookups, we analyze connectivity status distributions, track number portability, and map network operator coverage with comprehensive network identification. MNP lookup analytics focus on portability rates, original versus ported network comparison, and cost optimization opportunities through accurate routing. NT lookup reports classify number types, validate formatting, detect invalid ranges, and provide geographic distribution analysis.

Every dimension can be sliced and filtered by operator, country, route, time period, or custom criteria, allowing you to drill down into the exact data segments that matter for your specific use case. Cross-reference multiple metrics to uncover hidden patterns - for example, identify which mobile networks have the highest absent subscriber rates, or determine which routes deliver the most complete network data.

Seamless Integration with Your Workflow

Access analytics through multiple channels to fit your operational needs. View interactive dashboards directly in your browser with dynamic charts and real-time updates. Export comprehensive CSV reports for analysis in spreadsheet applications or integration with your internal business intelligence tools. Retrieve structured JSON data through our REST API for programmatic access and automated reporting pipelines.

Every lookup can be assigned to a named storage container, allowing you to organize results by client, campaign, project, or any custom classification that matches your business structure. Storages act as intelligent folders that automatically aggregate analytics for their contained lookups, making it effortless to generate client-specific reports or track campaign performance in isolation.

Actionable Intelligence for Strategic Decisions

Our analytics platform doesn't just show you data - it reveals opportunities. Identify underperforming routes and switch to higher-quality connections. Detect networks with systematic connectivity issues and adjust your routing strategy accordingly. Discover patterns in subscriber absence that indicate network maintenance windows or coverage gaps. Optimize costs by comparing route performance against pricing to find the best value-to-quality ratio.

For fraud prevention applications, our analytics help identify suspicious patterns such as unusual concentrations of invalid numbers, unexpected portability rates in specific ranges, or anomalous geographic distributions. Marketing teams use our reports to segment databases by network operator, ensuring messages are routed through the optimal delivery channels for each carrier. VoIP providers leverage our network intelligence to make real-time routing decisions that maximize call completion rates while minimizing interconnection costs.

Enterprise-Grade Performance & Reliability

Our analytics infrastructure is built to handle enterprise-scale data volumes without compromising performance. Process and analyze millions of lookups with subsecond query response times. Reports are generated asynchronously in the background, allowing you to queue multiple export jobs without waiting for completion. All data is stored with redundancy and backed up continuously, ensuring your historical analytics remain accessible and secure.

Explore the detailed feature sections below to discover the full capabilities of our analytics platform, including dashboard visualizations, real-time monitoring, connectivity metrics, network intelligence, advanced data extraction, route performance analysis, export options, storage management, and business application examples. To see our analytics in action, review our example reports for HLR Lookups, MNP Lookups, and NT Lookups.

Dashboard & Live Activity Feed

Your Command Center for Mobile Network Intelligence

The analytics dashboard serves as your central hub for monitoring HLR, MNP, and NT lookup operations across your entire infrastructure. Designed for high-volume environments, it provides instant visibility into current activity, historical performance, and emerging trends - all from a single, intuitive interface. Whether you're managing thousands of lookups per day or processing millions per month, the dashboard scales seamlessly to provide the insights you need without overwhelming you with unnecessary complexity.

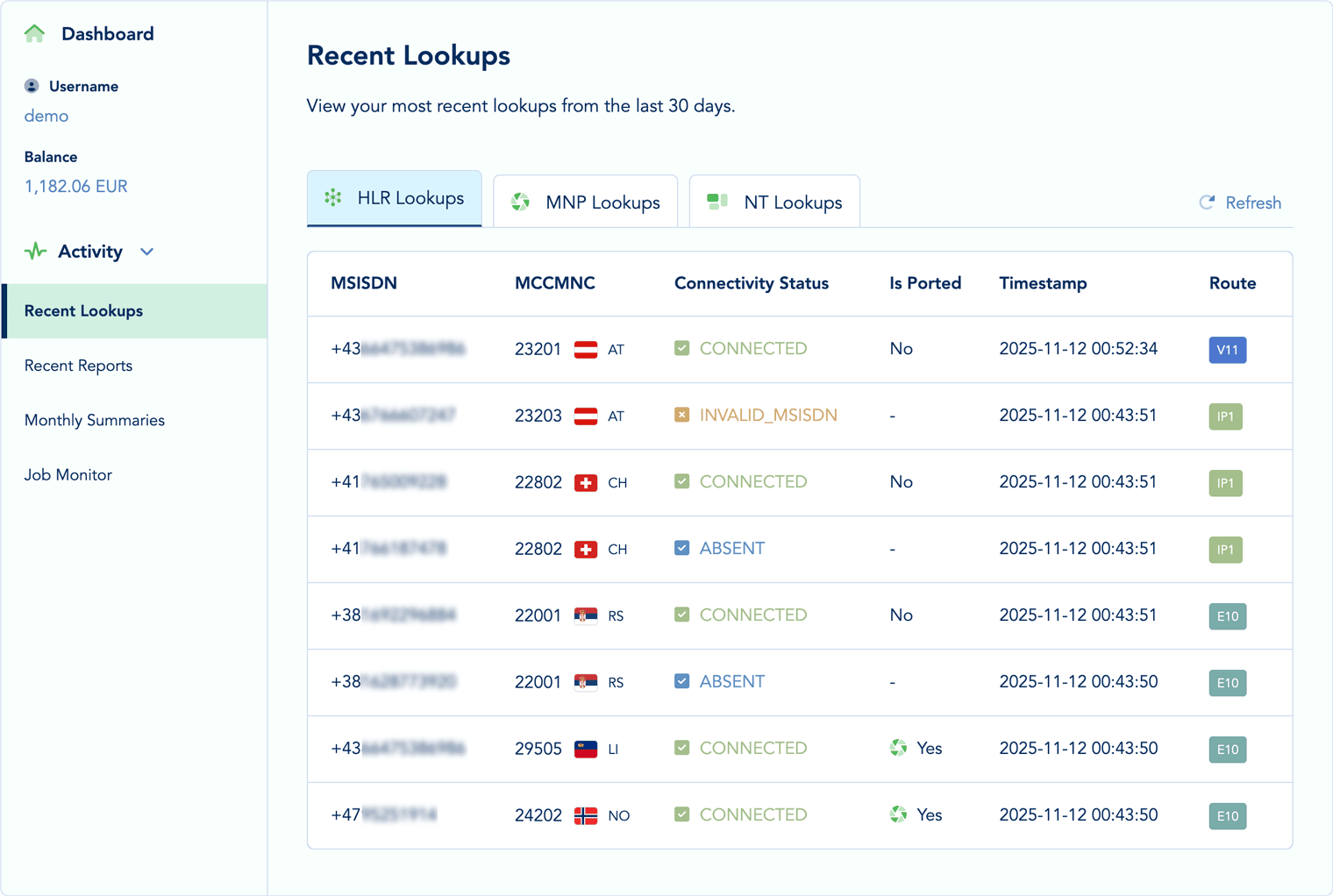

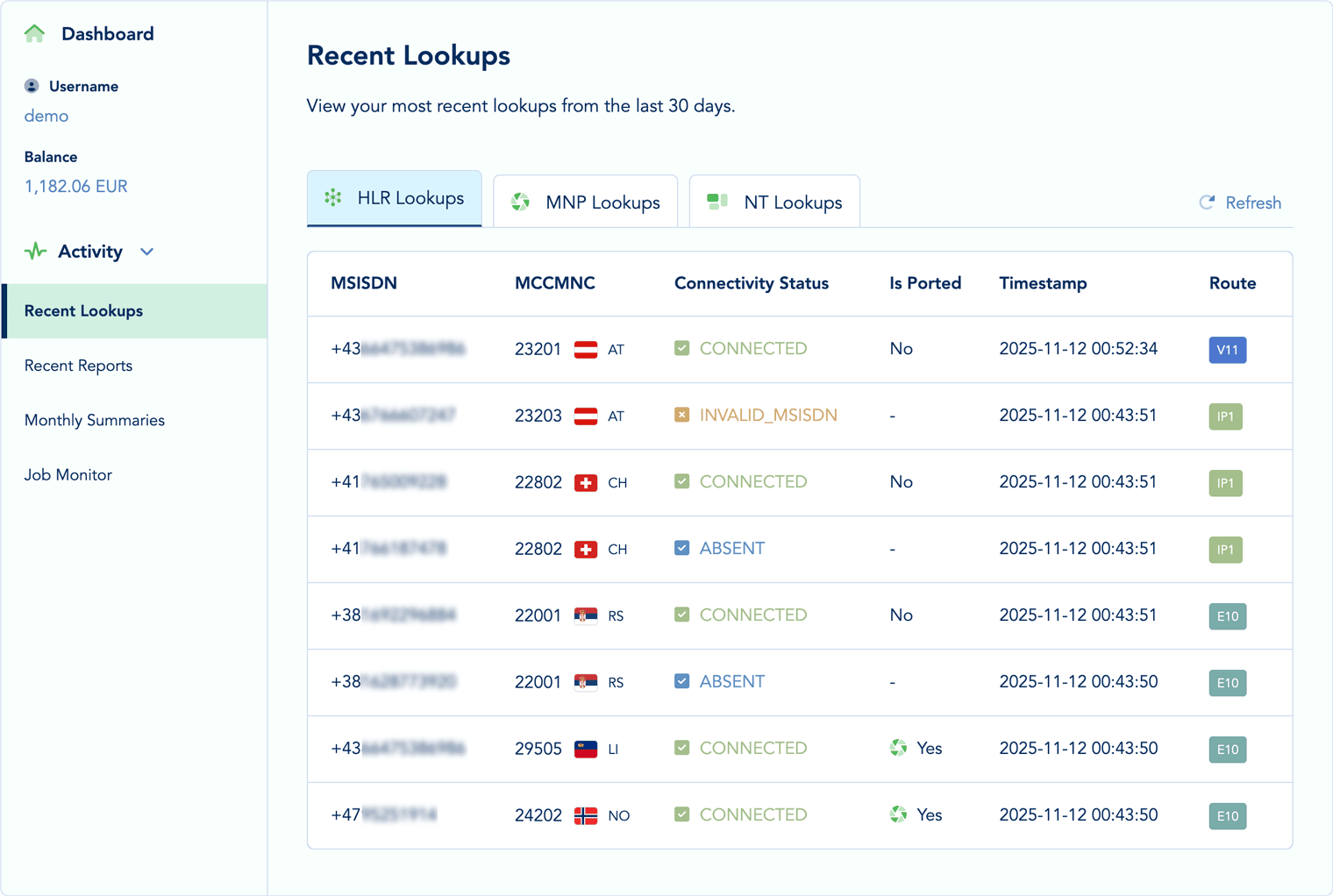

Real-Time Lookup Feed

Monitor your most recent lookup activity with our live feed that automatically updates as new results arrive. Every lookup is displayed with comprehensive details including MSISDN, connectivity status, network operator, country, route used, processing time, and cost. The feed intelligently organizes results by lookup type, allowing you to focus on HLR, MNP, or NT operations independently or view them side-by-side for comparative analysis.

Visual indicators instantly communicate lookup outcomes - green for successful connectivity, amber for absent subscribers, red for invalid numbers, and gray for undetermined status. For MNP lookups, ported numbers are clearly flagged with before-and-after network comparisons. NT lookups display color-coded number type classifications, making it effortless to distinguish mobile, landline, VoIP, and premium-rate numbers at a glance.

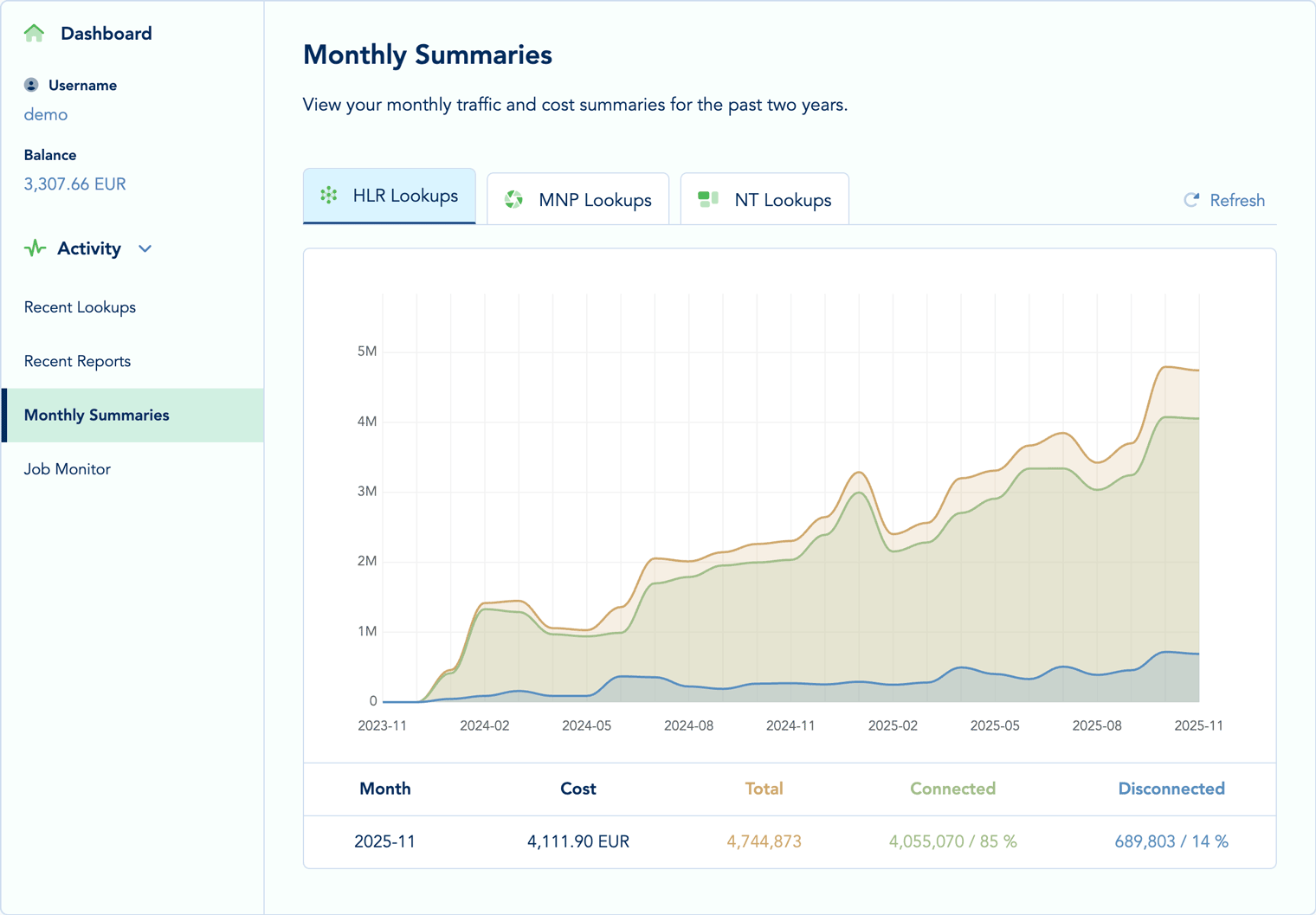

Monthly Performance Summaries

Track your lookup volume and spending patterns with interactive monthly summary charts that visualize trends over time. Our chart visualization automatically aggregates your HLR, MNP, and NT activity, displaying lookup counts, total costs, average cost per lookup, and success rates for each month. Identify seasonal patterns, measure the impact of operational changes, and forecast future resource requirements based on historical growth trajectories.

The monthly summary breaks down performance by lookup type, allowing you to compare HLR versus MNP usage patterns or track the adoption of NT validation services. Click any data point to drill down into detailed daily statistics, revealing granular insights about specific time periods. Export summary data to CSV for further analysis in spreadsheet applications or integration with your business intelligence systems.

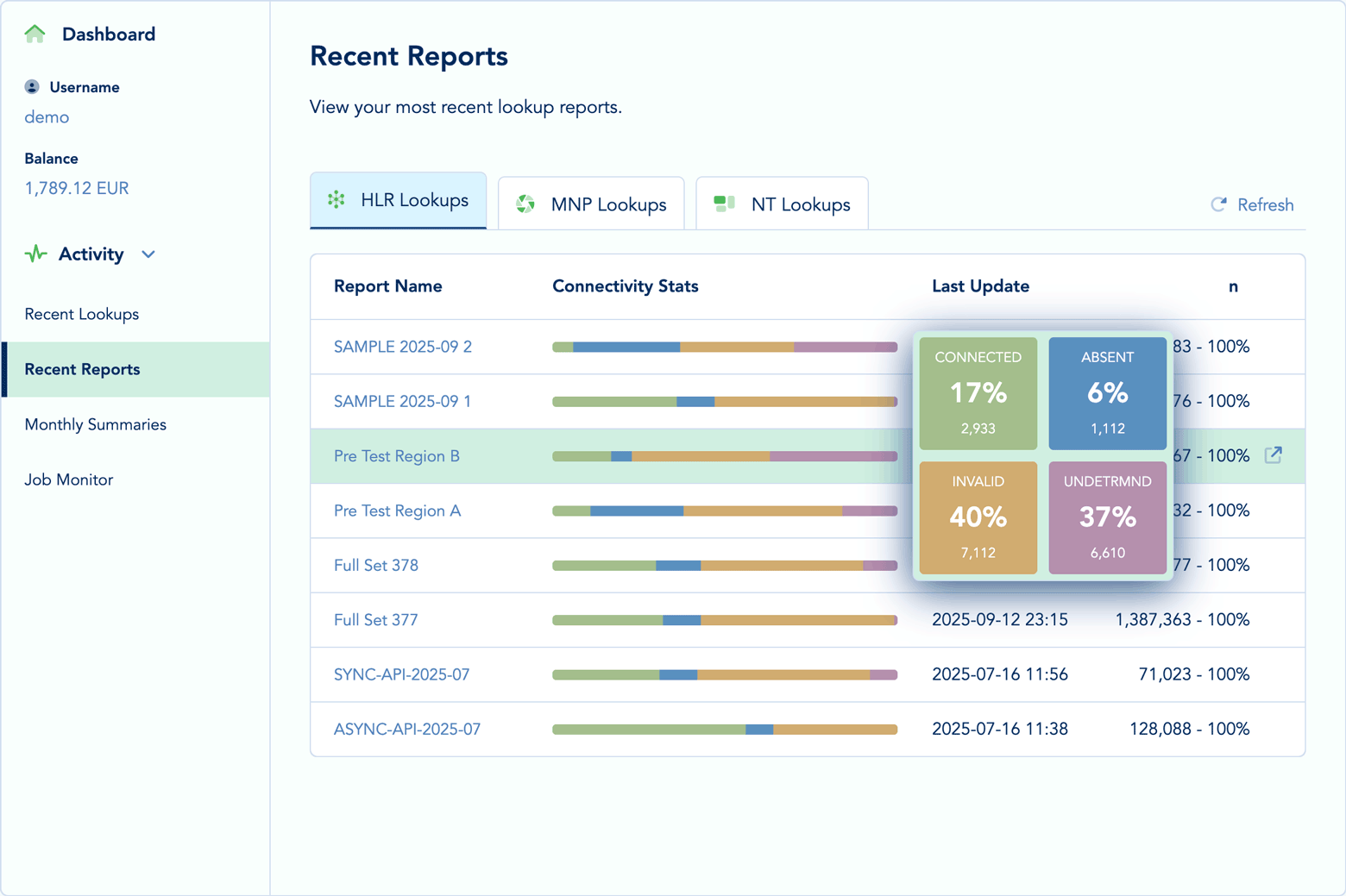

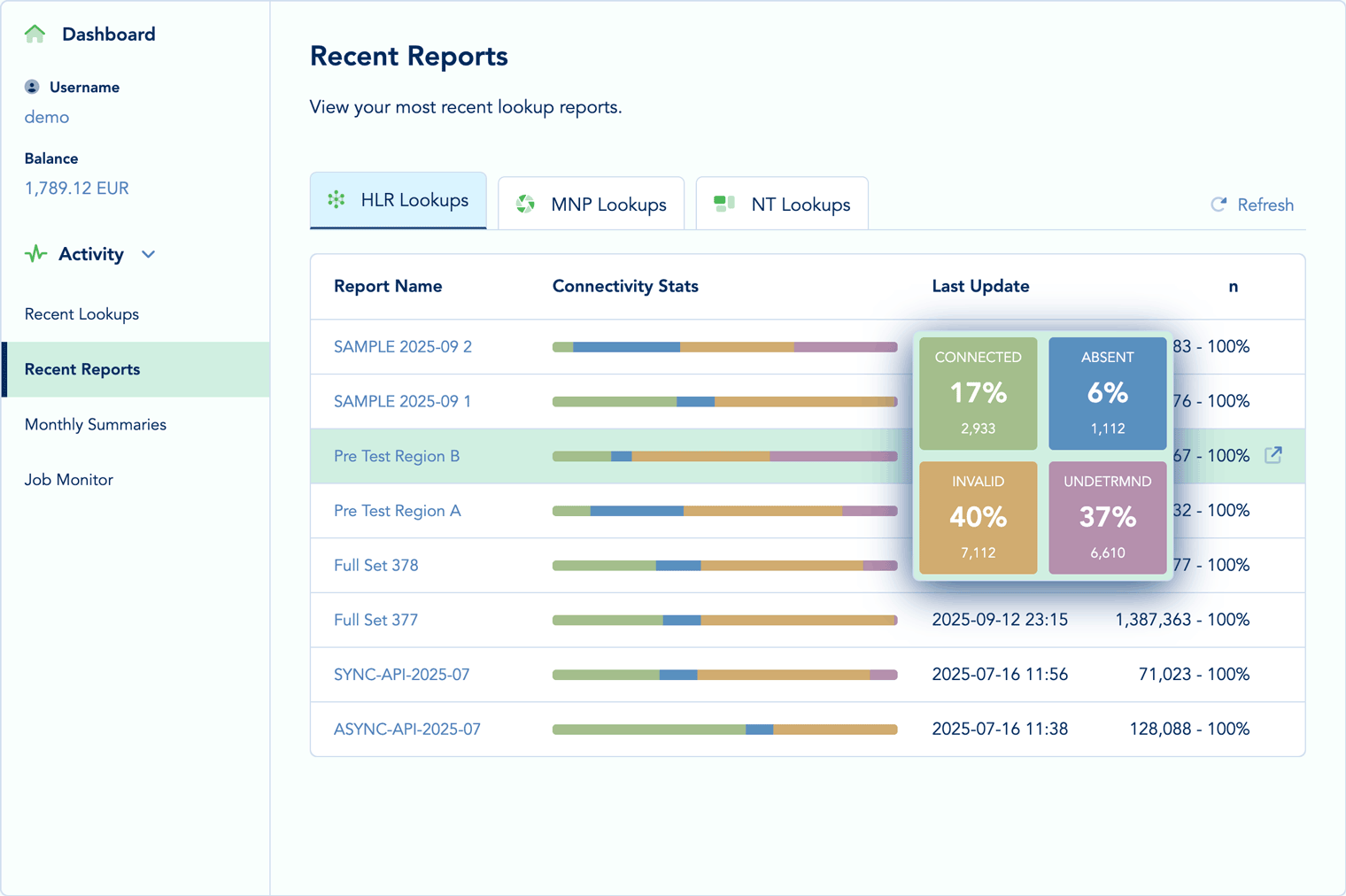

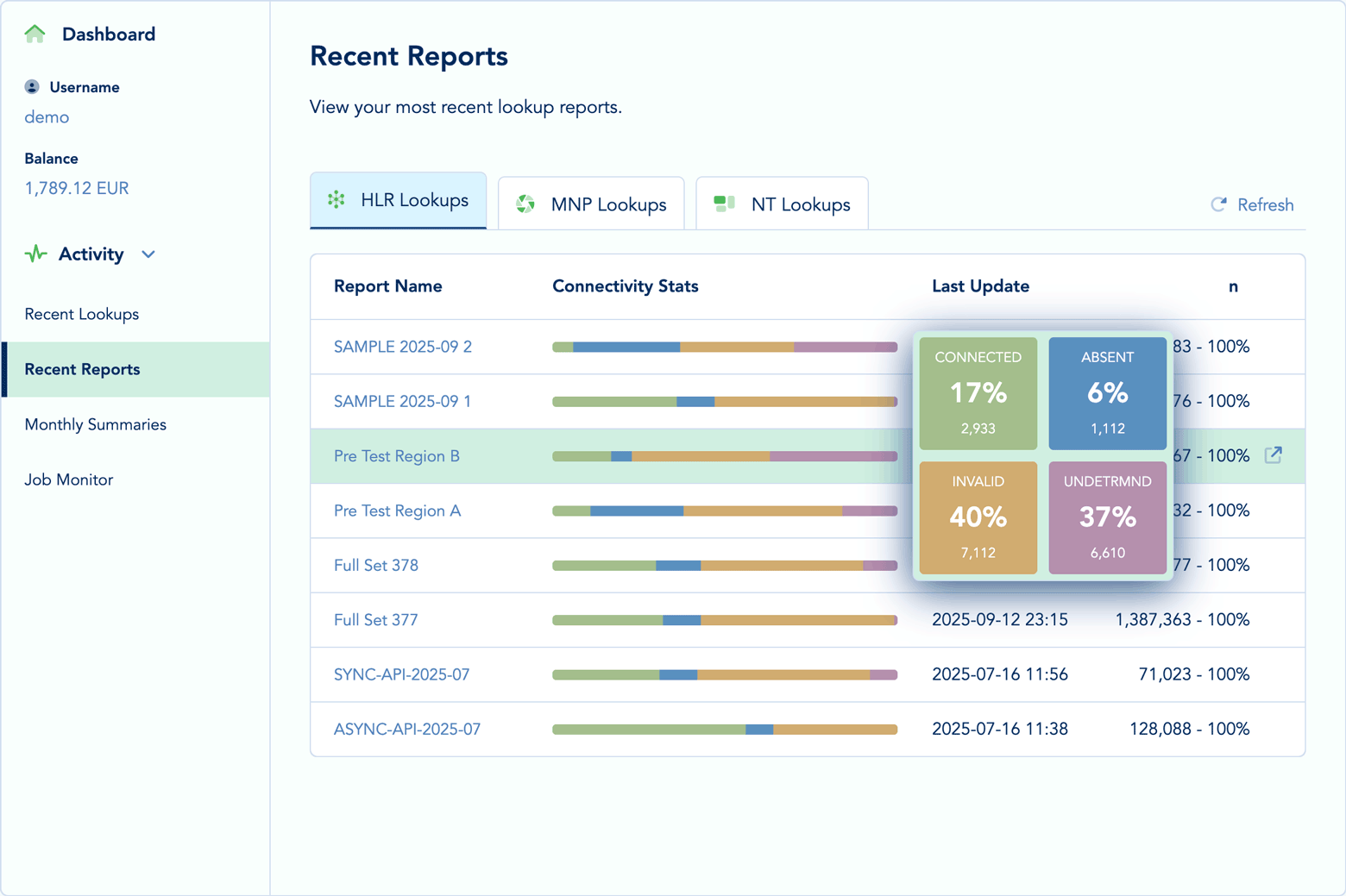

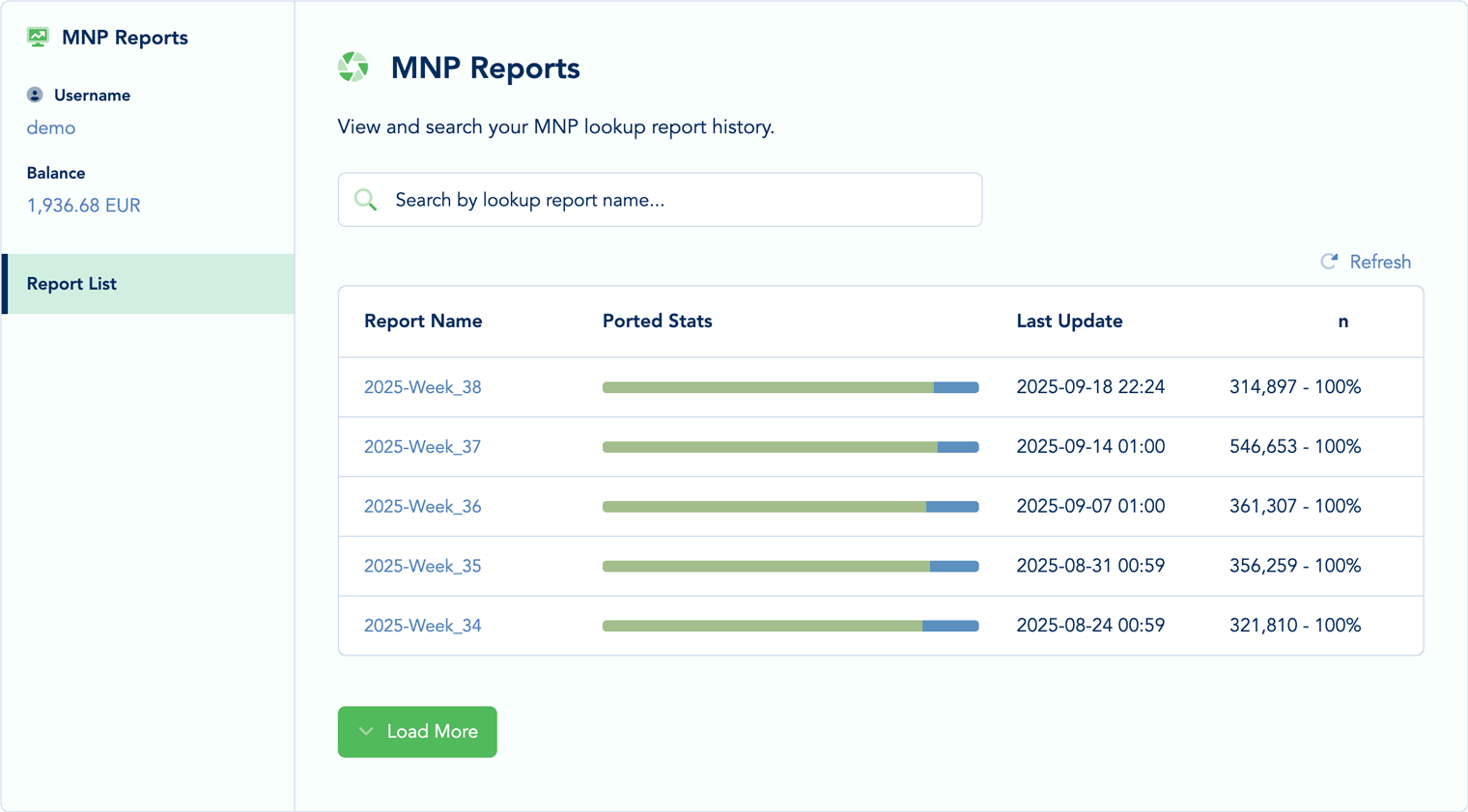

Recent Reports Overview

Access your latest generated reports instantly from the dashboard with our recent reports section. Each report entry displays the storage name, lookup count, creation timestamp, and a quick preview of key metrics such as connectivity rates or portability percentages. Click any report to open the full analytics view with detailed breakdowns by operator, country, and route. Preview example reports to see what your reports will look like: HLR, MNP, and NT.

Reports are organized by lookup type with separate tabs for HLR, MNP, and NT results, making it effortless to navigate between different analysis contexts. Star your most important reports for quick access, or use the search function to locate specific storages by name or date range. The dashboard automatically refreshes to show newly completed reports, ensuring you always have access to the most current data.

Active Job Monitor

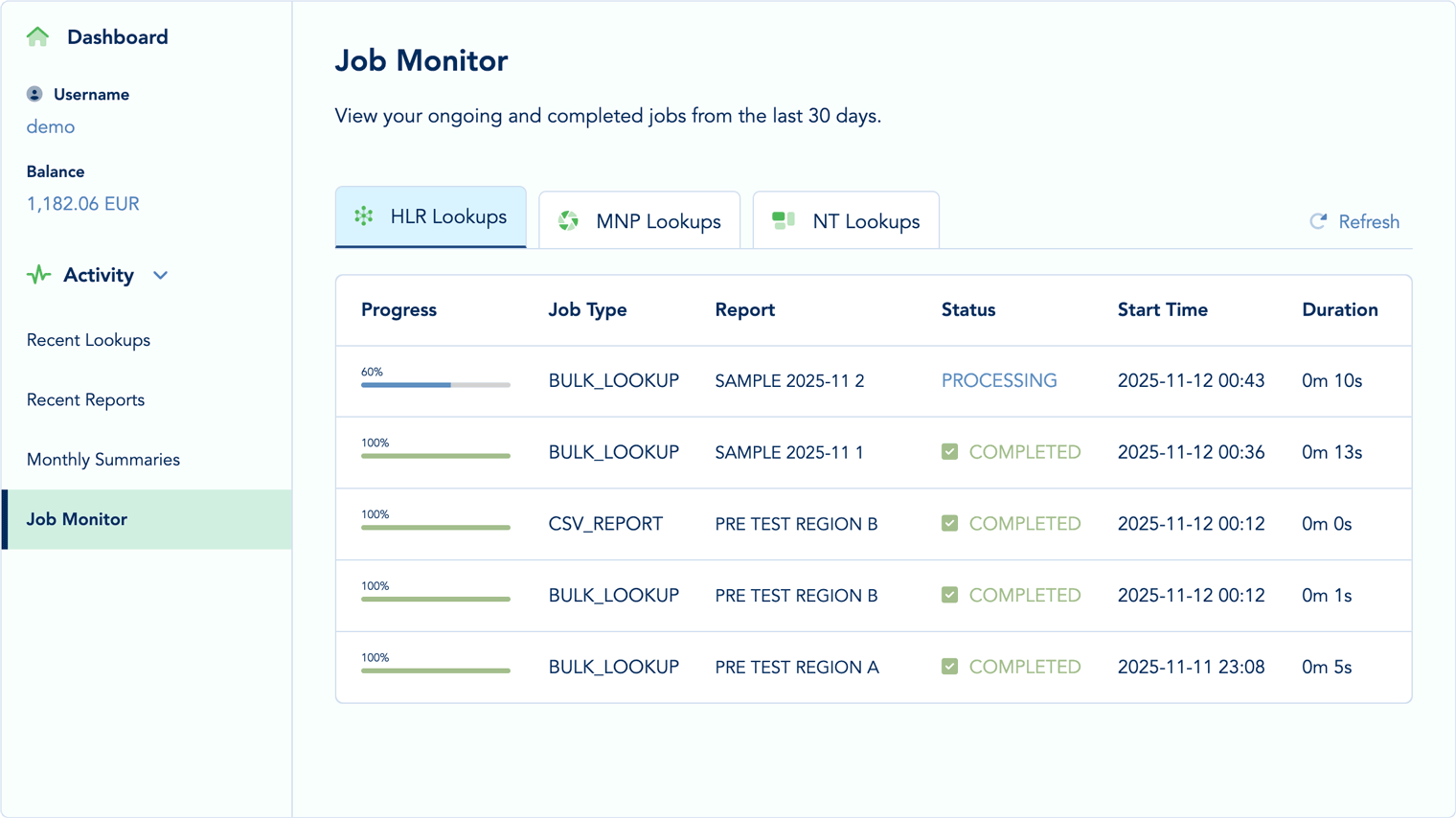

Track ongoing bulk processing jobs with our live job monitor that displays real-time progress indicators, estimated completion times, and current throughput rates. Each active job shows a visual progress bar indicating the percentage of MSISDNs processed, along with detailed statistics about success rates, error counts, and remaining items. The monitor automatically updates every few seconds, providing continuous visibility without requiring manual page refreshes.

Jobs are grouped by type (HLR, MNP, NT) with separate views that can be toggled using tab controls. For large jobs processing millions of numbers, the system displays intermediate milestones and provides downloadable partial results even before complete job termination. Historical job logs are preserved for 30 days, allowing you to review past processing runs and identify any recurring issues or performance bottlenecks.

Account Activity Visualization

Gain a holistic view of your account activity with summary tiles that display key performance indicators at a glance. Track total lookups performed, current account balance, average lookup cost, most-used routes, and top-performing networks. These KPIs are calculated in real-time and provide immediate feedback about your operational efficiency and spending patterns.

The dashboard also highlights important account events such as recent balance top-ups, route configuration changes, or anomalous activity that may require attention. Set up custom alerts to receive notifications when specific thresholds are exceeded - for example, when daily lookup volume surpasses expected levels or when account balance falls below a minimum threshold.

Customizable Dashboard Views

Tailor the dashboard to your specific needs by showing or hiding individual widgets, adjusting time ranges, and selecting which lookup types to display. Save multiple dashboard configurations for different use cases - create one view optimized for real-time monitoring, another focused on historical analysis, and a third dedicated to cost tracking. Share dashboard URLs with team members to provide read-only access to specific metrics or reports without granting full account permissions.

The dashboard automatically adapts to different screen sizes, providing a fully responsive experience whether you're monitoring from a desktop workstation, tablet, or mobile device. All visualizations are interactive - click, hover, and drill down to explore underlying data without leaving the dashboard interface.

Integration with Workflow Tools

Access dashboard metrics programmatically through our REST API to build custom integrations with your internal monitoring systems. Feed lookup statistics into your business intelligence platforms, trigger automated alerts based on metric thresholds, or generate scheduled reports that are automatically emailed to stakeholders. The dashboard data model is fully documented, making it straightforward to extract exactly the metrics you need for downstream processing.

Real-Time Monitoring & Job Tracking

Live Visibility into Lookup Processing Operations

Our real-time monitoring system provides continuous visibility into every aspect of your lookup processing pipeline, from initial submission through final result delivery. Whether you're processing individual numbers through our web client or submitting massive bulk jobs via the API, you'll have instant access to processing status, completion progress, and performance metrics. The monitoring infrastructure is built on our high-performance event streaming platform, delivering subsecond latency between actual processing events and dashboard updates.

Bulk Job Progress Tracking

When you submit bulk lookup jobs - whether through file upload, API batch requests, or async processing queues - our system immediately creates a tracking record that follows the job through its entire lifecycle. The job tracker displays a dynamic progress bar showing the percentage of MSISDNs processed, along with absolute counts of completed, pending, and failed lookups. Real-time throughput metrics show your current processing rate in lookups per second, while estimated completion time calculations help you plan downstream activities.

For HLR lookup jobs, the tracker breaks down results by connectivity status, allowing you to monitor the distribution of connected, absent, invalid, and undetermined numbers as processing unfolds. MNP job tracking highlights portability rates in real-time, showing how many numbers have been ported versus those remaining on their original networks. NT lookup jobs display live classification distributions, revealing the breakdown of mobile, landline, VoIP, and other number types as they're identified.

Live Processing Status Updates

The monitoring system automatically updates every 5 seconds without requiring manual page refreshes, ensuring you always see current information. Status transitions are highlighted with visual animations - watch as jobs move from 'Queued' to 'Processing' to 'Completing' to 'Completed', with each state change accompanied by updated metrics and timestamps. If processing errors occur, they're immediately surfaced with detailed error messages, affected MSISDN counts, and recommended remediation steps.

The system maintains a complete processing log for each job, recording every significant event including queue submission time, processing start time, worker assignment, intermediate checkpoints, and final completion timestamp. This detailed logging enables forensic analysis of job performance, helping you identify bottlenecks and optimize your submission patterns for maximum throughput.

Queue Monitoring & Capacity Planning

Our monitoring dashboard provides visibility into the processing queue itself, showing how many jobs are awaiting execution, current queue depth, and estimated wait times. During periods of high demand, the queue monitor helps you understand system load and make informed decisions about job prioritization. Enterprise customers with dedicated processing capacity can view their private queue status separately from shared infrastructure.

Historical queue metrics reveal patterns in processing demand, helping you identify peak usage periods and plan capacity accordingly. If you consistently see queue backlogs during specific time windows, you can adjust your submission schedule to smooth out load or work with your account manager to increase dedicated capacity.

Throughput Metrics & Performance Analysis

Track your actual processing throughput with charts that visualize lookups per second, lookups per minute, and hourly processing totals. Our infrastructure is designed to handle up to 1,000 HLR lookups per second per account, with MNP and NT lookups processing even faster due to their lower latency characteristics. Throughput graphs overlay your actual performance against theoretical maximums, making it easy to spot degradation or confirm that you're achieving optimal speed.

Route-specific throughput metrics help you understand which connections deliver the fastest response times. If you notice certain routes consistently underperforming, you can adjust your routing preferences or contact support to investigate potential issues with specific network providers. The system also tracks error rates by route, enabling you to identify and avoid problematic connections that might slow down your overall processing.

Error Rate Tracking & Alerting

Monitor lookup error rates with real-time tracking that categorizes failures by type, route, and network operator. Common error categories include invalid MSISDN format, unreachable networks, timeout errors, routing failures, and rate limit exceeded conditions. Each error type has associated documentation explaining the cause and recommended resolution steps.

The error tracking system calculates error rates as percentages of total lookups, making it easy to distinguish between isolated incidents and systematic problems. Set custom alert thresholds that trigger notifications when error rates exceed acceptable levels - for example, receive an email alert if more than 5% of lookups fail within a 15-minute window. Historical error rate trends help you measure the effectiveness of fixes and validate that route changes have improved reliability.

Multi-Job Concurrent Monitoring

Process multiple jobs simultaneously and monitor them all from a unified interface. The job list displays all active and recent jobs in chronological order, with expandable details for each entry. Filter the view by job type (HLR, MNP, NT), status (queued, processing, completed, failed), or date range to focus on specific operations.

For accounts running parallel processing workflows, the monitor clearly indicates which jobs are utilizing your dedicated capacity versus which are in shared queues. Job prioritization controls allow you to move urgent jobs ahead in the queue (enterprise feature), ensuring time-critical lookups complete before lower-priority batch operations.

API-Driven Monitoring Integration

All monitoring data is accessible through our REST API, enabling you to build custom dashboards or integrate lookup status into your own operational monitoring systems. Poll job status programmatically to detect completion, retrieve processing metrics for external analysis, or build automated workflows that trigger downstream actions when jobs finish. Webhook notifications are available to push job completion events to your servers in real-time, eliminating the need for continuous polling.

The monitoring API exposes detailed metrics including per-route statistics, error breakdowns, throughput measurements, and queue depths - everything visible in the web dashboard is also available through structured JSON responses. Rate limits for monitoring API calls are generous, allowing you to query status multiple times per second without impacting your lookup quotas or incurring additional charges.

Connectivity & Status Metrics

Comprehensive Analysis of Subscriber Reachability

Understanding subscriber connectivity status is fundamental to optimizing SMS delivery rates, reducing telecommunications costs, and maintaining clean contact databases. Our analytics platform processes every lookup result to extract connectivity patterns, portability information, and number validity indicators - transforming raw network responses into actionable business intelligence. Whether you're validating marketing lists, routing VoIP traffic, or detecting fraudulent accounts, these metrics provide the foundation for data-driven decision making.

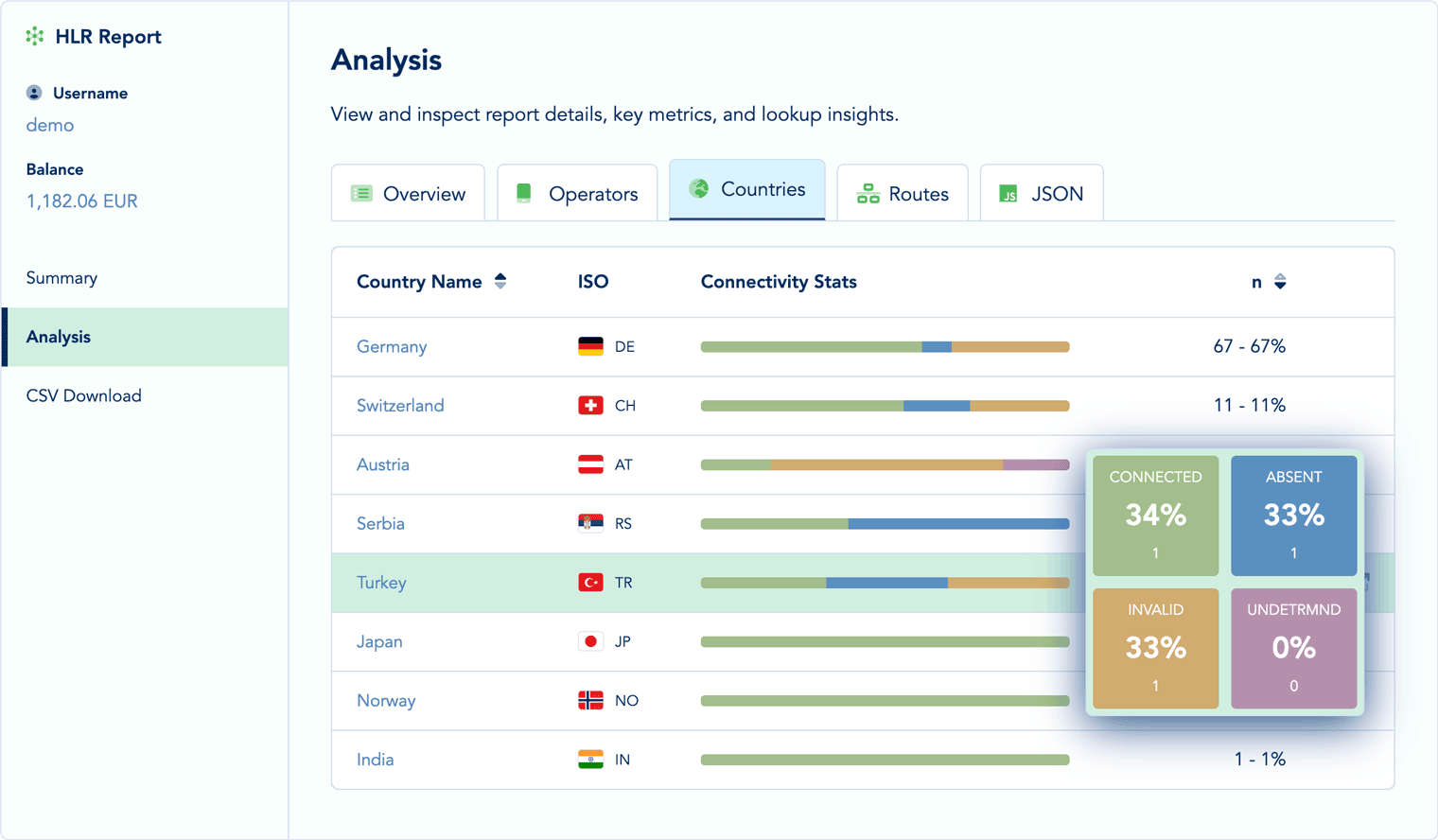

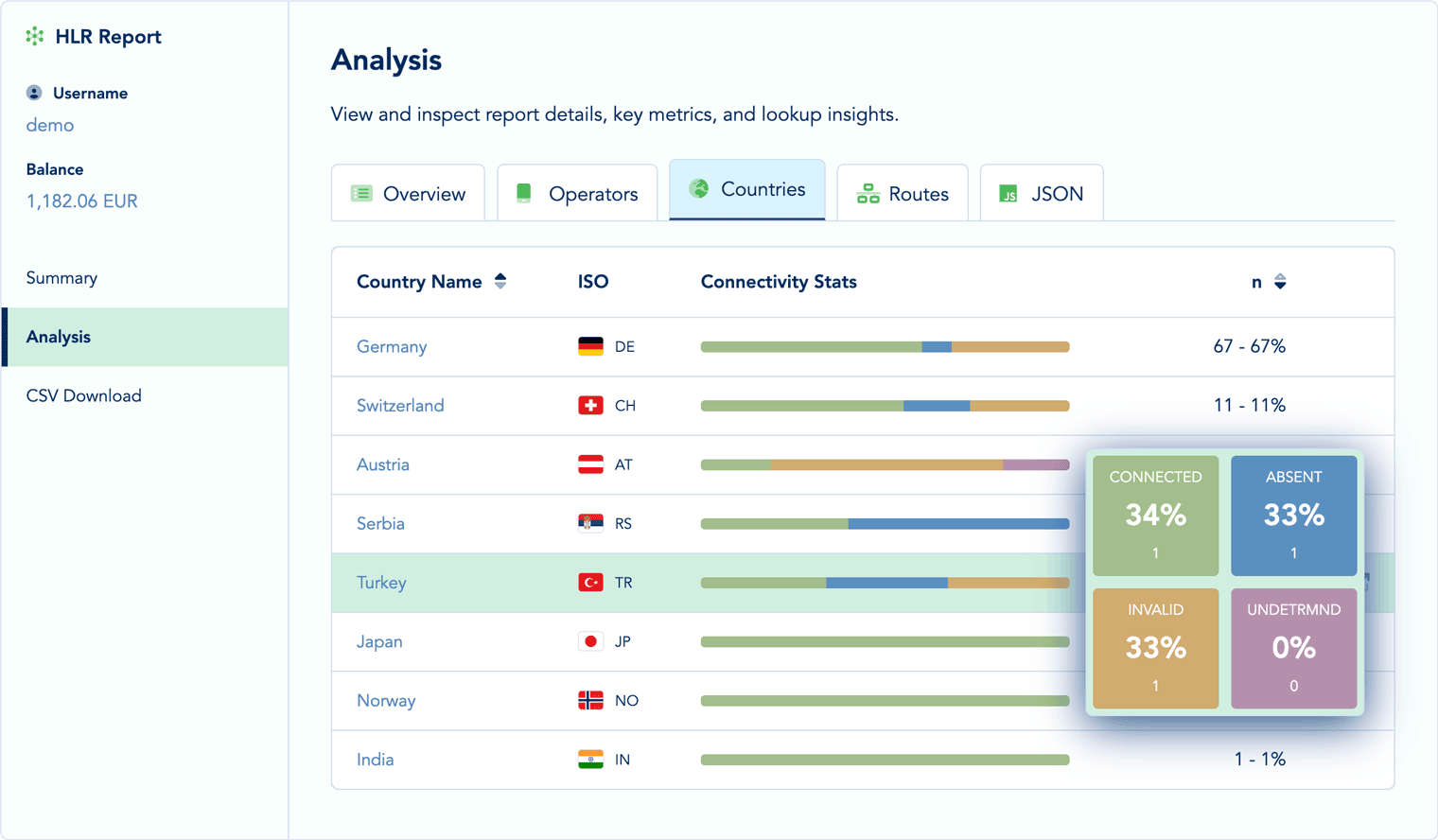

HLR Connectivity Status Distribution

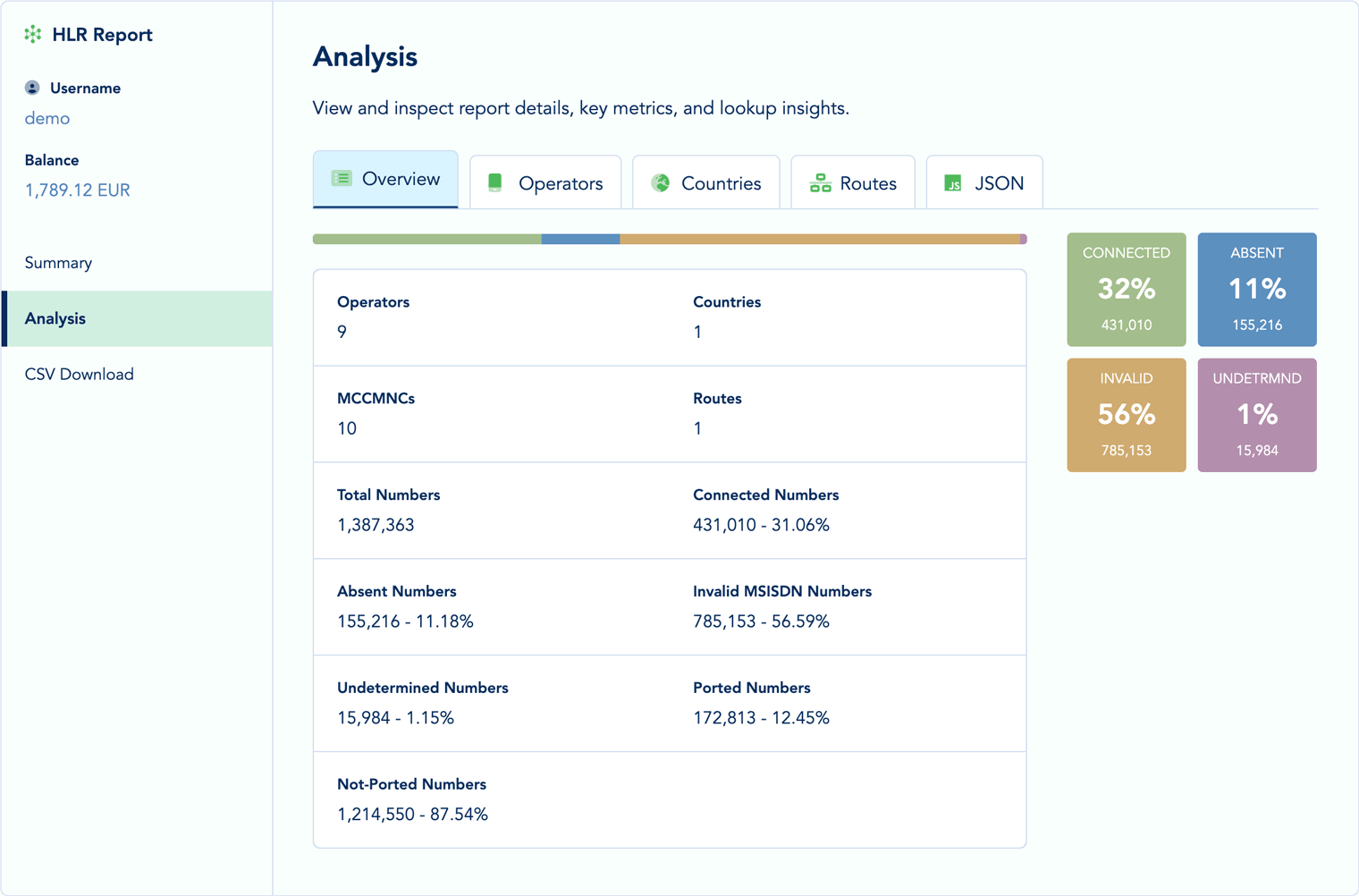

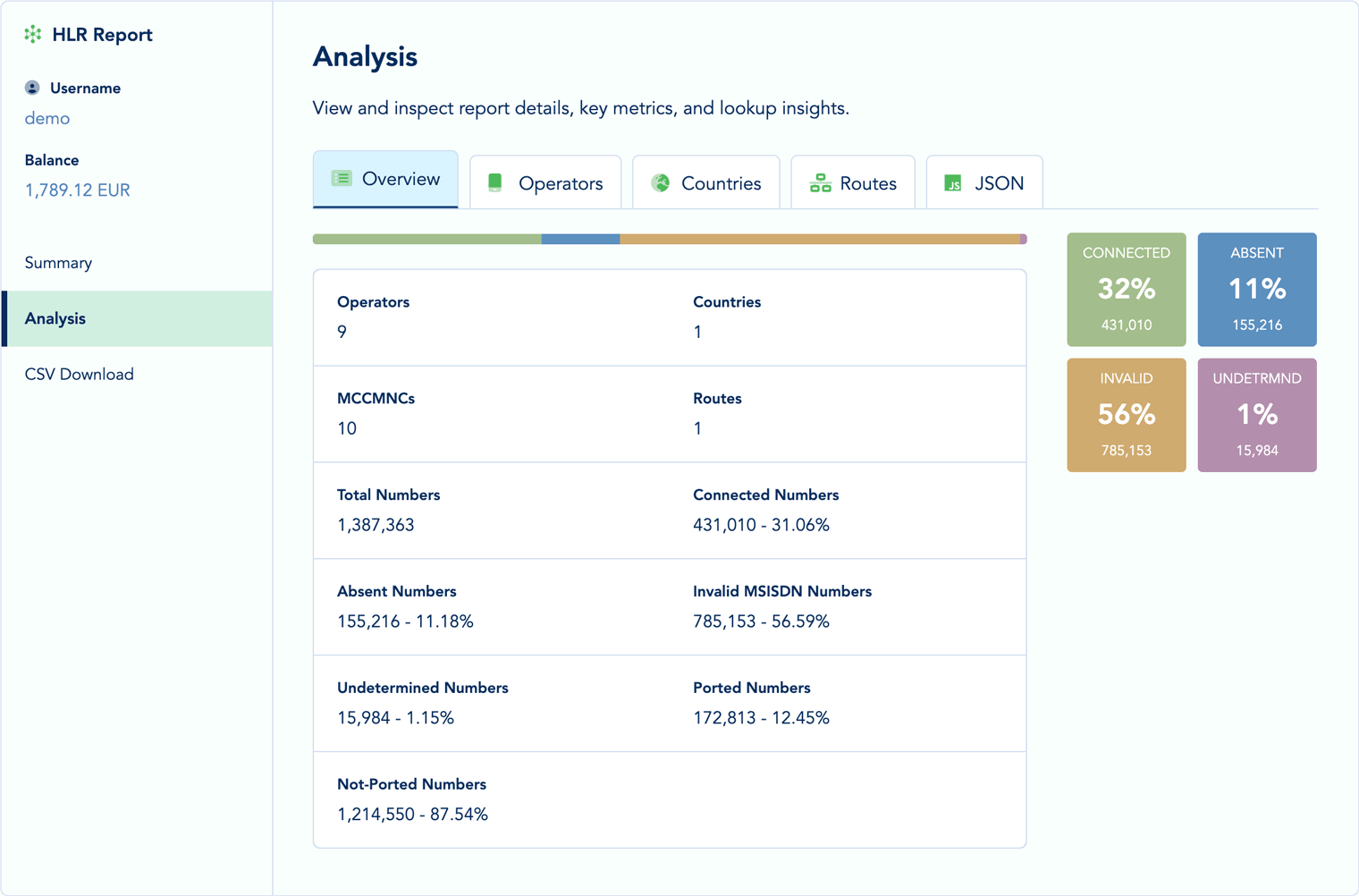

HLR (Home Location Register) lookups reveal the real-time connectivity status of mobile subscribers, categorizing each MSISDN into one of four primary states: Connected, Absent, Invalid, or Undetermined. Our analytics engine automatically calculates the distribution across these categories, presenting both absolute counts and percentage breakdowns that immediately highlight the quality and reachability of your number database. View our HLR example report to see these analytics in action.

Connected Subscribers

Connected status indicates that the mobile device is currently powered on, registered with the network, and capable of receiving SMS messages and phone calls. These are your highest-value contacts for immediate engagement - messages sent to connected numbers achieve the highest delivery rates with minimal latency. The analytics dashboard tracks connected rates over time, allowing you to identify optimal sending windows when your audience is most likely to be online.

Absent Subscribers

Absent status identifies valid mobile numbers where the device is temporarily unreachable - typically because it's powered off, in airplane mode, or in an area without network coverage. While these numbers cannot receive messages immediately, they remain valid for future delivery attempts. High absent rates during specific time periods may indicate timezone misalignment or reveal patterns in your audience's device usage behavior. Our system distinguishes between temporarily absent devices and permanently deactivated numbers, providing granular insight into the nature of delivery challenges.

Invalid MSISDNs

Invalid status flags numbers that were never assigned to any mobile network operator, have been permanently deactivated, or contain formatting errors that prevent network lookup. These numbers will never successfully receive SMS or calls and should be immediately removed from your contact database to avoid wasted delivery attempts and associated costs. Tracking invalid rates helps measure database hygiene - high invalid percentages suggest the need for more aggressive validation at the point of collection.

Undetermined Status

Undetermined status occurs when network responses are ambiguous or when technical issues prevent definitive status classification. This category typically represents less than 5% of lookups and may be caused by temporary network outages, routing problems, or numbers in transition between operators. Numbers with undetermined status can be re-queried after a short delay, often yielding conclusive results on subsequent attempts.

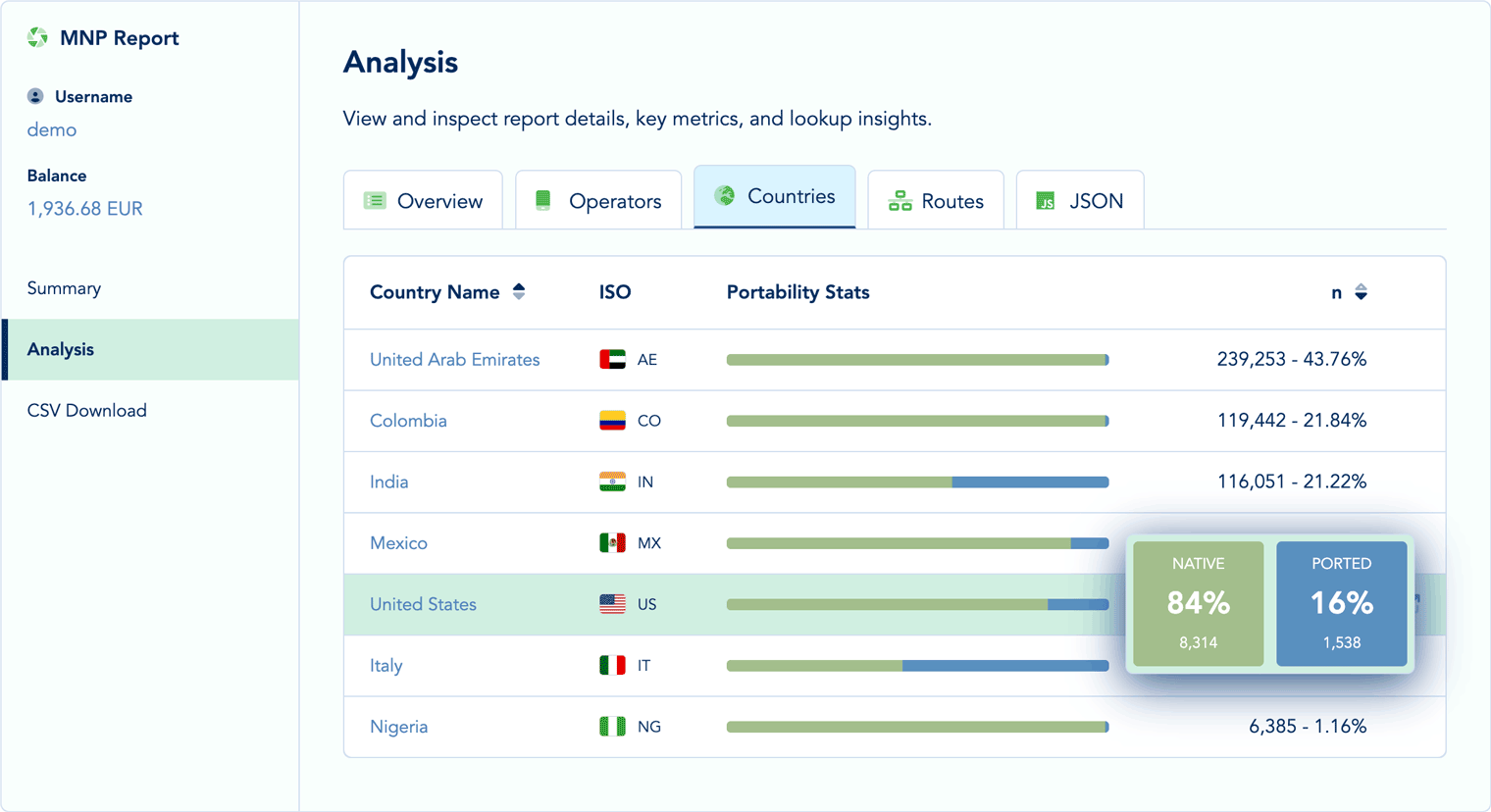

MNP Portability Analysis

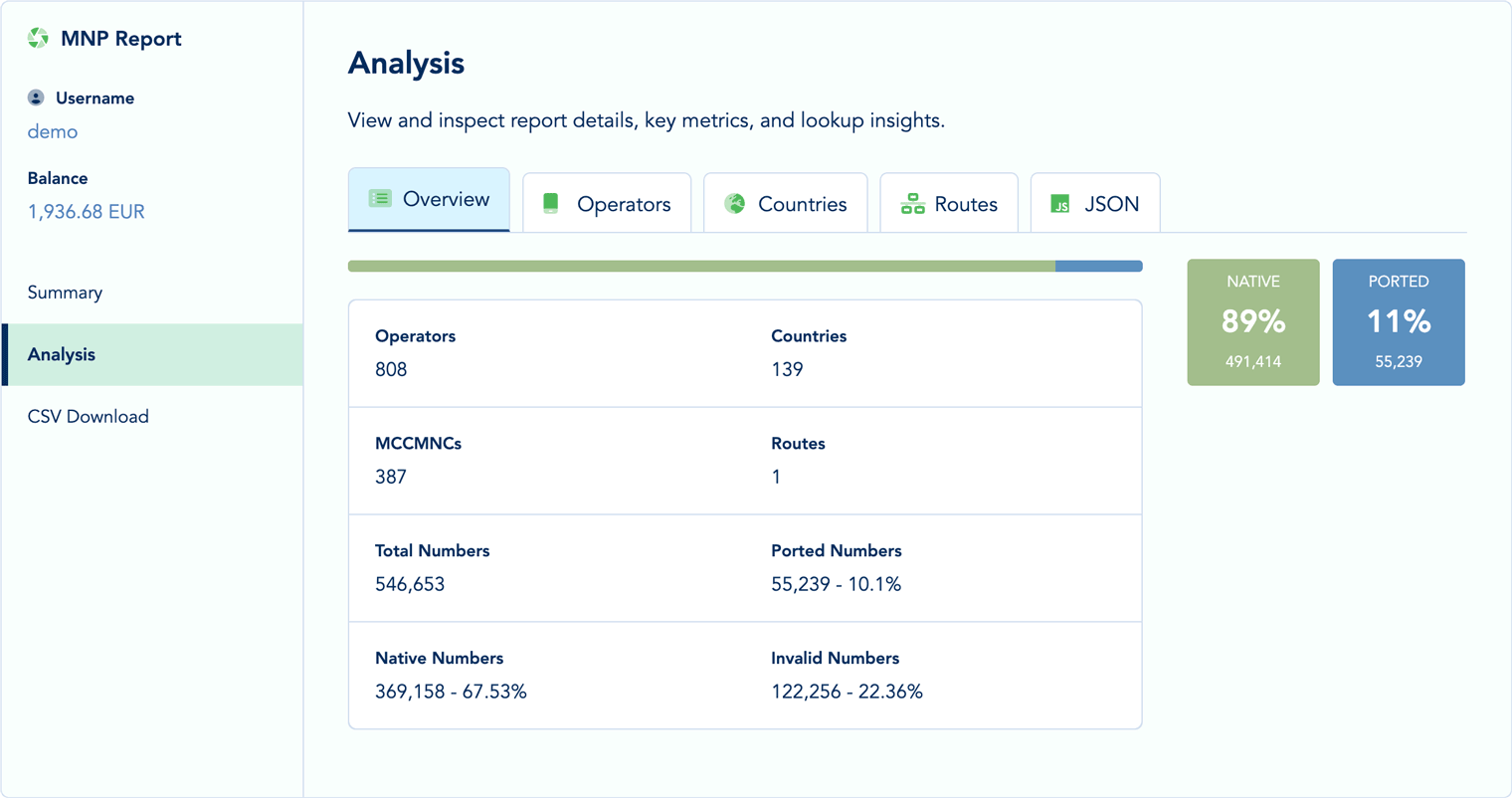

Mobile Number Portability (MNP) lookups determine whether phone numbers have been ported from their original network operator to a different carrier. This information is critical for accurate SMS routing, interconnection billing, and regulatory compliance in markets where number portability is widespread. Our portability analytics break down your number lists into ported versus native categories, with detailed network mapping showing original and current operators. Explore our MNP example report to see portability analytics visualized.

Ported Numbers

Ported numbers have been moved from their original network operator to a new carrier, typically at the subscriber's request to change providers while retaining their existing phone number. The analytics show both the original network (based on number range assignment) and the current ported network (based on live MNP database queries). Portability rates vary significantly by country and operator - some markets see 30-40% of mobile numbers ported, while others remain below 5%. Understanding ported distribution helps optimize routing decisions and predict interconnection costs accurately.

Native Numbers

Native numbers remain on their original network operator - the carrier that was allocated the number range containing the MSISDN. These numbers can often be routed more efficiently since network assignment can be determined from the number prefix without requiring real-time portability database lookups. High native rates within specific number ranges suggest strong customer retention by the incumbent operator or indicate recently allocated number blocks with insufficient time for porting to occur.

Portability Rate Trends

Track how portability rates change over time within your database, revealing market dynamics and subscriber behavior patterns. Increasing portability rates may indicate competitive pressure between operators or special promotional periods that encourage switching. Geographic analysis of portability rates helps identify regional differences in carrier preferences and market saturation.

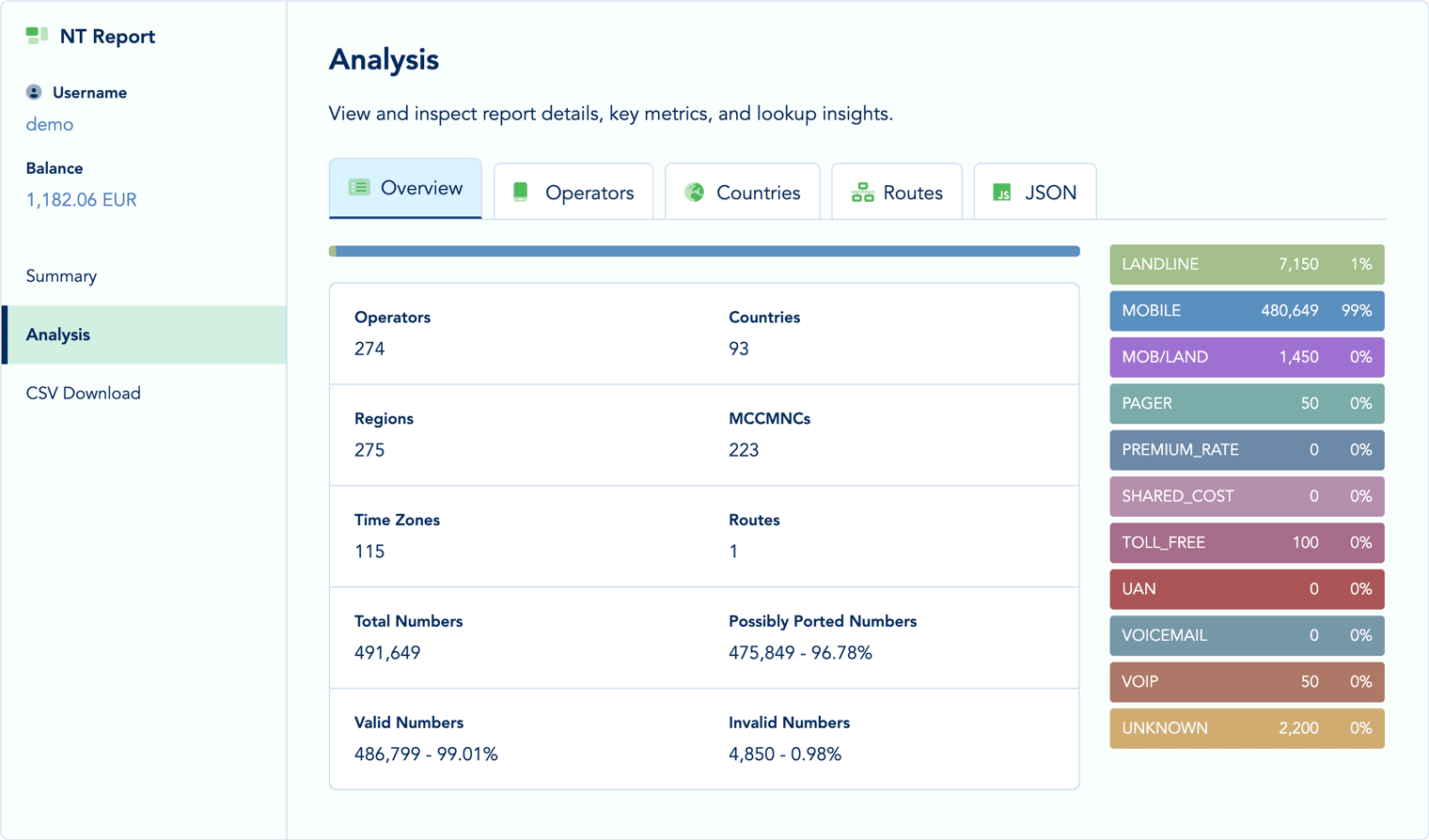

NT Number Type Classification

Number Type (NT) lookups classify phone numbers into categories such as mobile, landline, VoIP, toll-free, premium rate, pager, and shared cost services. This classification is essential for compliance filtering (many regulations prohibit SMS to landlines), cost optimization (mobile delivery has different economics than landline), and fraud detection (premium numbers in unexpected contexts may indicate scams). Review our NT example report to see number type classification analytics.

Mobile Numbers

Mobile classification indicates the number is assigned to a cellular network operator and capable of receiving SMS messages and mobile voice calls. These are your target numbers for mobile marketing campaigns, two-factor authentication, and application notifications. Mobile numbers may be further subdivided by network type (GSM, CDMA, LTE) depending on the granularity of available network data.

Landline Numbers

Landline classification identifies traditional fixed-line telephone numbers that cannot receive SMS messages through standard mobile gateways. These numbers should be filtered out of SMS distribution lists to avoid delivery failures and compliance violations. However, landlines remain valid for voice calling applications and may indicate business contacts versus consumer mobile users.

VoIP Numbers

VoIP (Voice over IP) numbers are associated with internet-based telephony services that may or may not support SMS delivery depending on the provider's capabilities. These numbers are increasingly common for business communications and virtual phone systems. VoIP classification helps identify potential fraud risk in scenarios where physical device presence is expected, as VoIP numbers can be activated anywhere with internet connectivity.

Premium Rate & Special Services

Premium rate numbers charge higher fees for incoming calls or messages, while toll-free numbers provide free calling for the caller with costs borne by the number owner. Identifying these special service numbers helps prevent unexpected costs and flags potential abuse scenarios. Shared cost numbers split calling charges between caller and recipient, requiring special handling in billing systems.

Operator-Level Status Breakdowns

Drill down into connectivity metrics at the mobile network operator level to identify performance variations between carriers. Some operators consistently deliver higher connected rates due to superior network coverage, while others may show elevated absent subscriber percentages in rural regions. Operator-specific analysis reveals which networks provide the most complete HLR data with comprehensive network details versus those returning minimal information.

Compare portability rates across operators to understand market dynamics - operators losing customers through portability may offer promotional opportunities, while those gaining ported numbers demonstrate competitive advantage. For NT lookups, operator-level classification helps validate that number ranges are correctly mapped and identifies discrepancies between expected and actual number type assignments.

Geographic Status Distribution

Analyze connectivity and portability metrics by country and region to understand geographic patterns in your data. Countries with mature mobile markets often show different connectivity profiles than emerging markets - for example, higher smartphone penetration correlates with increased connected rates during business hours. Portability rates vary dramatically by geography based on regulatory frameworks and market competition intensity.

Time zone alignment affects connectivity metrics - numbers in time zones experiencing nighttime hours will naturally show higher absent rates. The system can normalize for time zones when comparing cross-geographic performance, eliminating temporal effects to reveal true connectivity differences.

Historical Trends & Predictive Insights

Track how connectivity metrics evolve over time within your database, revealing trends in number validity and subscriber behavior. Declining connected rates over multiple lookups of the same numbers may indicate churn - subscribers canceling service or switching to new numbers. Increasing invalid rates suggest database aging and highlight the need for regular validation campaigns to maintain list hygiene.

Seasonal patterns in connectivity become apparent through longitudinal analysis - holiday periods, vacation seasons, and weather events all influence when subscribers are reachable. Use historical patterns to predict optimal engagement timing and forecast how upcoming campaigns will perform based on past results in similar conditions.

Network Intelligence & Operator Analysis

Deep Insights into Mobile Network Infrastructure

Every HLR, MNP, and NT lookup extracts valuable intelligence about the underlying mobile network infrastructure serving your target numbers. Our analytics platform aggregates this network data to provide comprehensive visibility into operator distribution, country coverage, MCCMNC allocations, and network topology patterns. This intelligence powers strategic decisions about routing optimization, interconnection partner selection, fraud detection, and market analysis.

Mobile Network Operator (MNO) Identification

Understanding which mobile network operators serve your contact database is fundamental to optimizing telecommunications operations. Our system extracts and catalogs every unique MNO encountered during lookup processing, building a comprehensive map of operator distribution within your number lists. Each operator entry includes the official network name, country of operation, associated MCCMNC codes, and aggregate statistics about numbers served.

Operator identification goes beyond simple name extraction - the system resolves operator mergers, acquisitions, and rebranding to maintain consistent historical tracking. When network operators change names or consolidate operations, our database updates automatically while preserving historical context through operator relationship mappings. This ensures your analytics remain accurate even as the global telecommunications landscape evolves.

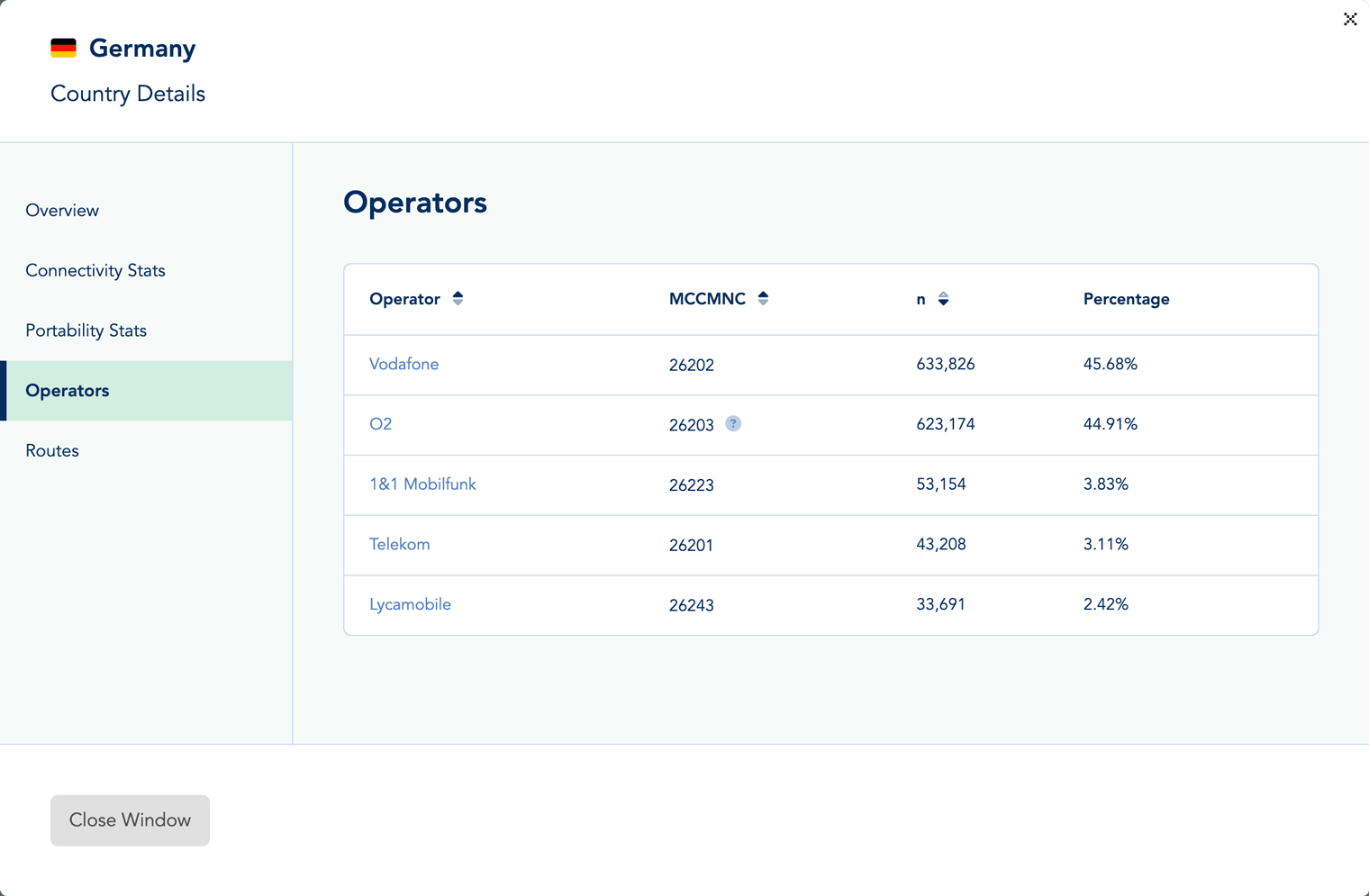

Operator Distribution Analysis

Visualize how your numbers distribute across mobile network operators with interactive charts showing both absolute counts and percentage breakdowns. This distribution reveals market share within your specific database - which may differ significantly from overall market statistics depending on your audience demographics and acquisition channels. Understanding operator concentration helps predict routing costs, identify opportunities for direct interconnection agreements, and assess exposure to single-operator service disruptions.

The analytics highlight dominant operators representing large portions of your traffic, medium-sized operators with significant but minority representation, and long-tail operators that collectively serve small percentages but may require special handling. For international operations, operator distribution analysis reveals geographic market penetration and helps prioritize which regions deserve dedicated infrastructure investment.

Country-Level Network Mapping

Analyze mobile network distribution by country to understand geographic diversity and concentration risks within your database. Each country entry shows total number count, unique operators present, connectivity statistics, and portability rates where applicable. The system automatically enriches country data with contextual information such as telecommunications regulatory environment, typical interconnection costs, and known network infrastructure challenges.

Country analysis helps identify markets where you have sufficient volume to justify direct relationships with local operators or aggregators. It also reveals unexpected geographic distributions that may indicate data quality issues - for example, high concentrations of numbers in countries where you don't expect business activity could signal fraudulent signups or data entry errors.

MCCMNC Code Analysis

The MCCMNC (Mobile Country Code + Mobile Network Code) is the fundamental identifier for mobile networks worldwide, with each operator assigned unique codes for routing and billing purposes. Our analytics extract and catalog every distinct MCCMNC encountered, providing definitive network identification that transcends operator name ambiguities. The MCC component (first 3 digits) identifies the country, while the MNC component (2-3 remaining digits) specifies the specific operator within that country.

MCCMNC analysis is particularly valuable for international operations where operator names may be ambiguous or translated differently across systems. By standardizing on MCCMNC codes, you ensure consistent routing decisions and accurate cost allocation even when dealing with operators unfamiliar to your staff. The system maintains a comprehensive database of MCCMNC assignments, updated regularly as new codes are allocated or existing ones are reassigned.

MCCMNC Distribution Patterns

Visualize MCCMNC distribution to identify concentration risks and routing optimization opportunities. High concentration in specific MCCMNC ranges suggests opportunities for negotiated volume pricing with corresponding operators. Conversely, highly fragmented MCCMNC distribution across many small operators indicates the need for aggregator relationships that provide consolidated access.

Tracking MCCMNC distribution over time reveals changes in your database composition - for example, increasing diversity may indicate successful geographic expansion, while decreasing diversity might reflect market consolidation or focused acquisition strategies.

Network Operator Hierarchy & Relationships

Many mobile network operators function as part of larger corporate groups or maintain MVNO (Mobile Virtual Network Operator) relationships where virtual operators use physical infrastructure owned by host networks. Our analytics platform maps these relationships, showing both the commercial operator brand visible to subscribers and the underlying network infrastructure provider handling actual traffic.

Understanding MVNO relationships is critical for routing optimization - while MVNOs appear as distinct operators, traffic ultimately terminates on their host network, potentially allowing consolidated routing that reduces interconnection fees. The system identifies MVNO arrangements automatically based on network prefix analysis, operator data, and maintained relationship databases.

Network Coverage Analysis

Assess actual network coverage quality by correlating operator presence with connectivity success rates. Some operators consistently deliver high connected percentages across their subscriber base, indicating robust network infrastructure and good device-network compatibility. Others may show elevated absent or undetermined rates, suggesting coverage gaps, infrastructure problems, or network configuration challenges.

Coverage analysis extends beyond simple connectivity to examine data richness - operators that consistently provide complete HLR data with comprehensive network details versus those returning minimal responses. This intelligence guides routing decisions toward operators that deliver maximum data value, especially important for applications requiring detailed network intelligence.

Operator-Specific Connectivity Patterns

Each mobile network operator exhibits unique connectivity patterns based on infrastructure quality, subscriber demographics, and geographic coverage footprint. Our analytics identify these patterns by comparing connectivity status distributions across operators. Premium operators in developed markets typically show 70-85% connected rates during business hours, while operators in emerging markets or rural-focused carriers may see 40-60% connected rates due to network quality variations or subscriber behavior differences.

Temporal connectivity patterns vary by operator - some networks show strong day-night cycles correlating with subscriber activity, while others maintain relatively stable connectivity levels suggesting different usage patterns or device technologies. Understanding these patterns helps optimize message timing, predict delivery success rates, and identify operators where retry strategies deliver meaningful improvements.

New Operator Detection & Monitoring

The telecommunications industry constantly evolves with new operators launching, existing operators merging, and MVNOs entering markets. Our analytics automatically detect when lookups encounter previously unseen operator identifiers, flagging them for investigation and database enrichment. This ensures your network intelligence remains current even in rapidly changing markets.

New operator alerts help identify emerging routing opportunities - newly launched operators often offer competitive interconnection rates to build traffic volume. Conversely, operators disappearing from your analytics (no recent lookups) may indicate network shutdowns, merger completions, or shifts in your customer base that warrant investigation.

Operator Performance Benchmarking

Compare operators across multiple dimensions including connectivity rates, data completeness, response latency, and cost efficiency. The benchmarking system ranks operators within each country or region, making it easy to identify top performers and underperformers. Use these rankings to inform routing preference configurations, prioritizing operators that deliver optimal results for your specific requirements.

For enterprise customers with dedicated routing controls, operator performance benchmarks directly influence automated routing decisions. The system can automatically preference high-performing operators while degrading or avoiding consistently problematic networks, continuously optimizing your lookup quality without manual intervention.

Strategic Intelligence Applications

Network intelligence derived from lookup analytics powers strategic business decisions beyond immediate operational optimization. Market entry analysis uses operator distribution data to assess potential opportunity sizes and competitive landscapes in target regions. Partnership prioritization identifies operators representing sufficient traffic volume to justify direct commercial relationships versus those better served through aggregators.

Fraud detection benefits from operator intelligence - unexpected operator concentrations, unusual MCCMNC patterns, or geographic distributions inconsistent with business models often indicate fraudulent signups or data acquisition problems. Customer segmentation strategies leverage operator data as a proxy for demographics - premium operators suggest higher-value subscribers, while budget operator concentration may indicate price-sensitive customer segments.

Advanced Network Data & Intelligence

Comprehensive Network Intelligence Beyond Basic Status

Beyond basic connectivity status and operator identification, HLR lookups can extract detailed technical intelligence from mobile networks when operators support enhanced data provision. Our analytics platform processes and aggregates this advanced data - including detailed network assignments, portability records, and infrastructure information - transforming raw network responses into strategic intelligence. This premium data enables sophisticated use cases such as accurate network identification, precise routing decisions, and comprehensive operator relationship optimization.

Network Assignment Intelligence

Definitive network assignment information provides the most authoritative operator identification, serving as the foundation for accurate routing decisions regardless of number portability or display characteristics. Our analytics track network assignment availability rates, catalog unique network identifiers, and correlate assignment patterns with operator infrastructure and subscriber behaviors. This intelligence ensures routing accuracy and helps validate that numbers terminate on expected networks for billing and quality assurance purposes.

Network Identifier Intelligence

Network identifiers definitively establish operator assignment, providing routing intelligence that supersedes number-based assumptions affected by portability. These identifiers enable precise network targeting independent of MSISDNs - particularly valuable in markets with high number portability rates where MSISDN prefixes no longer reliably indicate current operator. Tracking network identifier availability by operator helps identify networks that consistently provide complete data versus those returning minimal information.

Network Data Availability Metrics

Our analytics calculate network data availability as the percentage of successful HLR lookups that return comprehensive network assignment information. Rates vary significantly by operator and route - premium routes accessing tier-1 networks often achieve 80-95% comprehensive data availability, while cost-optimized routes or operators with restricted data policies may deliver only 30-50%. Understanding these availability patterns helps set appropriate expectations for downstream applications relying on detailed network data and guides routing decisions when comprehensive information is critical.

Track network data availability trends over time to detect changes in operator data policies or route performance degradation. Sudden drops in data availability may indicate route problems, operator policy changes, or technical issues requiring investigation and potential route adjustment.

Infrastructure Intelligence Tracking

Network infrastructure information reveals the physical network topology serving mobile subscribers. This infrastructure-level intelligence provides insights into network architecture, load distribution, and geographic serving areas. Infrastructure data is particularly valuable for VoIP routing optimization, understanding operator network topology, and validating expected network configurations.

Infrastructure Address Intelligence

Network infrastructure addresses identify the specific network elements handling subscriber traffic. Our analytics extract and catalog unique infrastructure identifiers, building a map of network topology that reveals operator coverage patterns and infrastructure distribution. By correlating infrastructure addresses with geographic regions, you can understand how operators architect their networks - centralized infrastructure versus distributed edge deployments.

Infrastructure analysis helps identify when subscribers connect through different network elements, potentially indicating geographic movement or network reconfigurations. Unexpected infrastructure assignments may flag potential irregularities or network routing anomalies requiring investigation. For international operations, infrastructure data helps distinguish local network termination from alternative routing paths, optimizing decisions based on actual network infrastructure rather than assumptions.

Infrastructure Data Availability & Quality

Infrastructure data availability varies by operator and route, with typical availability rates ranging from 40% to 90% depending on network data policies and query protocols. Operators in markets with strong data privacy regulations may restrict infrastructure information provision, while others freely share network topology details. Our analytics track infrastructure data availability rates by operator, route, and country, helping you understand where this intelligence is reliably available versus where it remains limited.

Number Portability Deep Dive

While basic MNP lookups identify whether numbers are ported, HLR lookups provide enhanced portability intelligence including original network assignments, current ported networks, and complete portability context when available. Our advanced analytics correlate portability status with connectivity patterns, revealing how ported numbers behave and identifying operators with significant subscriber movement.

Original Network Identification

The original network represents the operator that was initially allocated the number range containing each MSISDN. This assignment is permanent based on numbering plan allocations and provides historical context about subscriber origins regardless of subsequent porting events. Analyzing original network distribution reveals number range allocations and helps validate that porting detection accurately identifies network changes.

Current Network & Porting Events

For ported numbers, analytics extract both the original and current network operators, calculating portability matrices that show movement between specific operator pairs. These matrices reveal competitive dynamics - which operators are losing customers to competitors, which are gaining through successful acquisition, and whether portability flows are bidirectional or predominantly one-way. Portability flow analysis helps predict future routing patterns and identifies operators experiencing network quality or customer service issues that drive churn.

Portability Timing & Patterns

When timing information is available, the system analyzes portability patterns to understand number lifecycle characteristics. Recently ported numbers may still exhibit transition characteristics - temporary routing inconsistencies as databases update, or delivery variations as systems synchronize. Long-established ported numbers behave identically to native numbers, with porting status relevant primarily for accurate operator identification and routing optimization.

Combined Intelligence Correlation

The true power of advanced data extraction emerges when correlating multiple intelligence dimensions simultaneously. Combine network assignment data with infrastructure information to validate that subscribers are served by expected network elements for their operator. Cross-reference connectivity status with portability information to understand how ported subscribers exhibit different behavioral patterns. Correlate network data availability with connectivity outcomes to identify whether certain subscriber states affect data provision rates.

Our analytics engine performs these multi-dimensional correlations automatically, surfacing insights that would be impossible to identify through manual analysis. For example, discovering that ported numbers show 15% higher absent rates than native numbers on the same current operator might indicate technical issues with portability implementations. Or identifying that specific infrastructure elements correlate with higher invalid rates could reveal network problems requiring operator attention.

Data Enrichment & Enhancement

Advanced data extraction enables database enrichment that adds significant value beyond initial lookup purposes. Append detailed network assignment, infrastructure references, and complete porting history to your customer records, creating enriched profiles that support sophisticated segmentation and targeting. Use network intelligence to enhance fraud scoring models, validate user-provided information, and detect account anomalies through infrastructure-level verification.

The enrichment data remains relatively stable - network assignments rarely change unless subscribers switch operators, infrastructure elements change only with network reconfigurations, and porting events are infrequent after initial migration. This stability makes advanced data highly valuable for long-term database enhancement, with periodic refresh lookups sufficient to detect changes and maintain accuracy.

Route Performance & Optimization

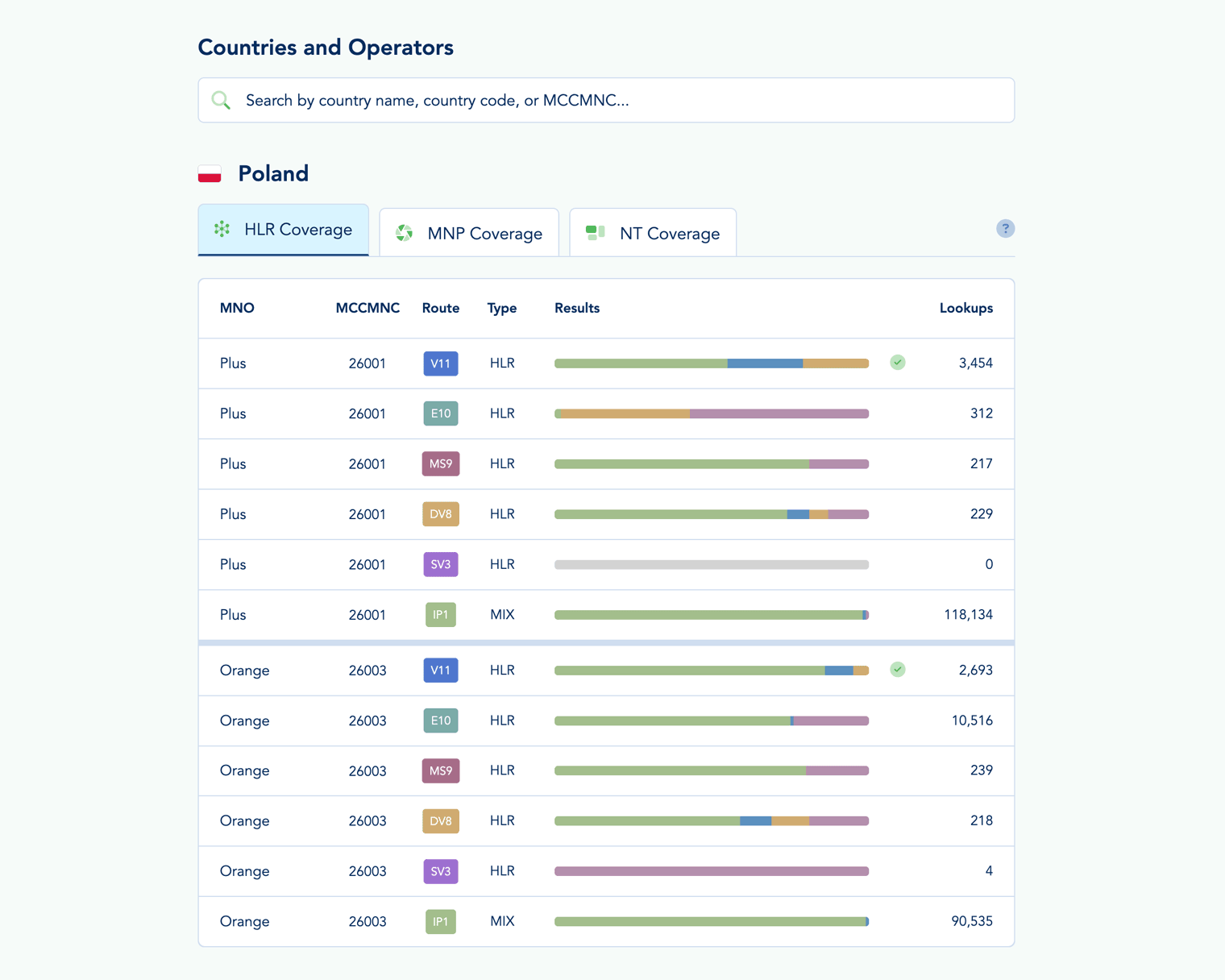

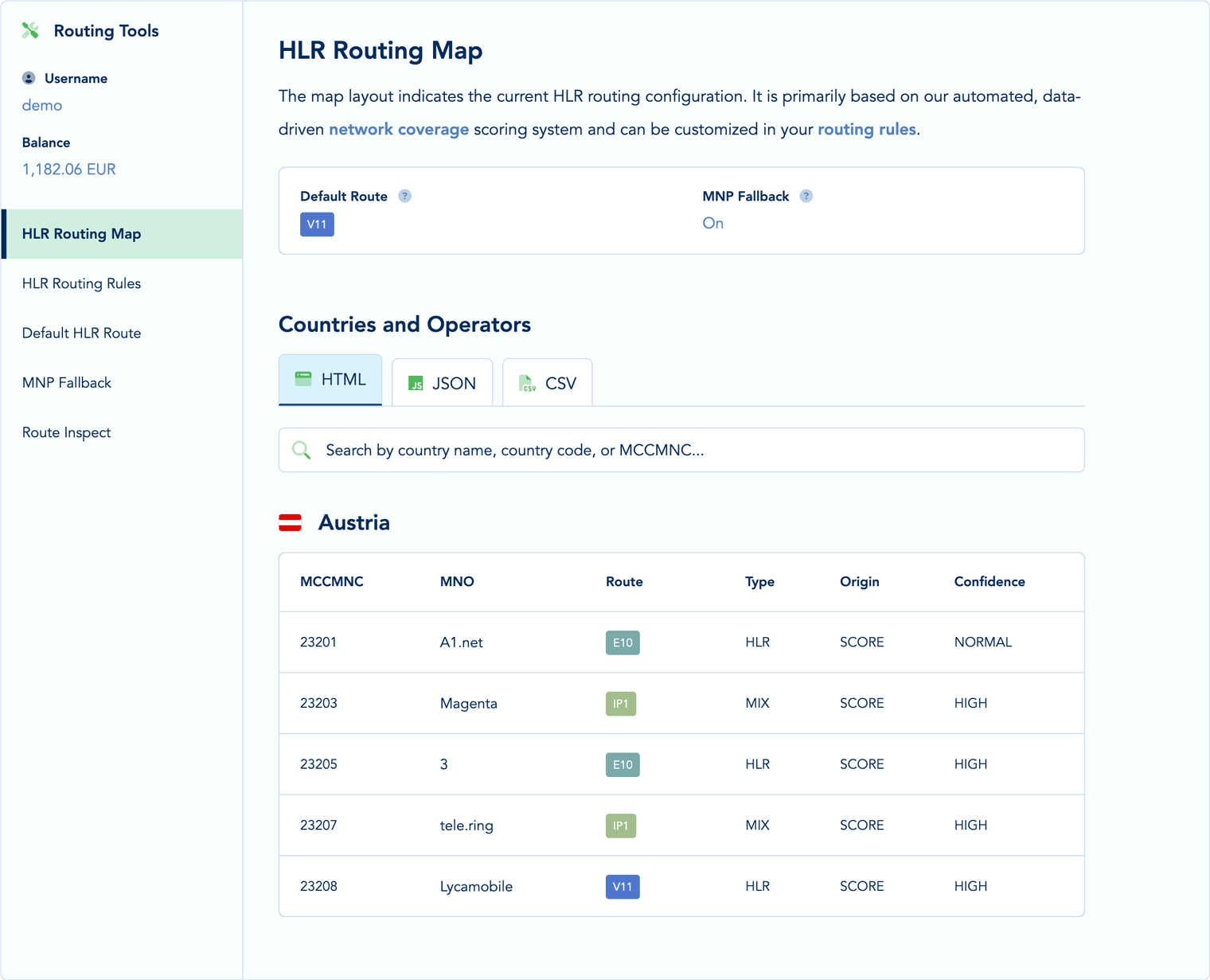

Our platform offers multiple routing options for HLR, MNP, and NT lookups, each representing distinct network connections with unique performance characteristics, coverage footprints, and cost structures.

| Route | Type | MCCMNC | Ported | Connected | Roaming * | Sync API | Async API |

|---|---|---|---|---|---|---|---|

| V11 | HLR | ||||||

| E10 | HLR | ||||||

| MS9 | HLR | ||||||

| DV8 | HLR | ||||||

| SV3 | HLR | ||||||

| IP1 | MIX |

* Availability depends on the target network operator.

HLR lookups leverage multiple redundant SS7 routes to maximize network reach. Each route utilizes distinct global titles for SS7 access, ensuring stability and reliability. By default, our system intelligently selects the best-performing route for your lookup requests. However, if you need more control, you can specify your preferred route in the API or web client. Please contact your account manager to discuss advanced routing configurations and automation.

| Route | Type | MCCMNC | Ported | Connected | Roaming | Sync API | Async API |

|---|---|---|---|---|---|---|---|

| PTX | MNP | ||||||

| IP4 | MNP |

MNP lookups provide a cost-effective alternative to HLR queries when your primary objective is identifying the current MCCMNC (Mobile Country Code + Mobile Network Code) of a given phone number. These lookups accurately determine both the original and ported network, offering a streamlined solution for routing optimization, fraud prevention, and compliance.

| Route | Number Type | Region | Time Zone | Carrier | MCCMNC | Sync API | Async API |

|---|---|---|---|---|---|---|---|

| LC1 |

NT (number type) lookups classify phone numbers based on their assigned numbering range. Instantly determine whether a number belongs to a mobile, landline, VoIP, premium rate, shared cost, or other network category. This feature is essential for ensuring compliance, filtering out non-mobile numbers, and optimizing communication strategies.

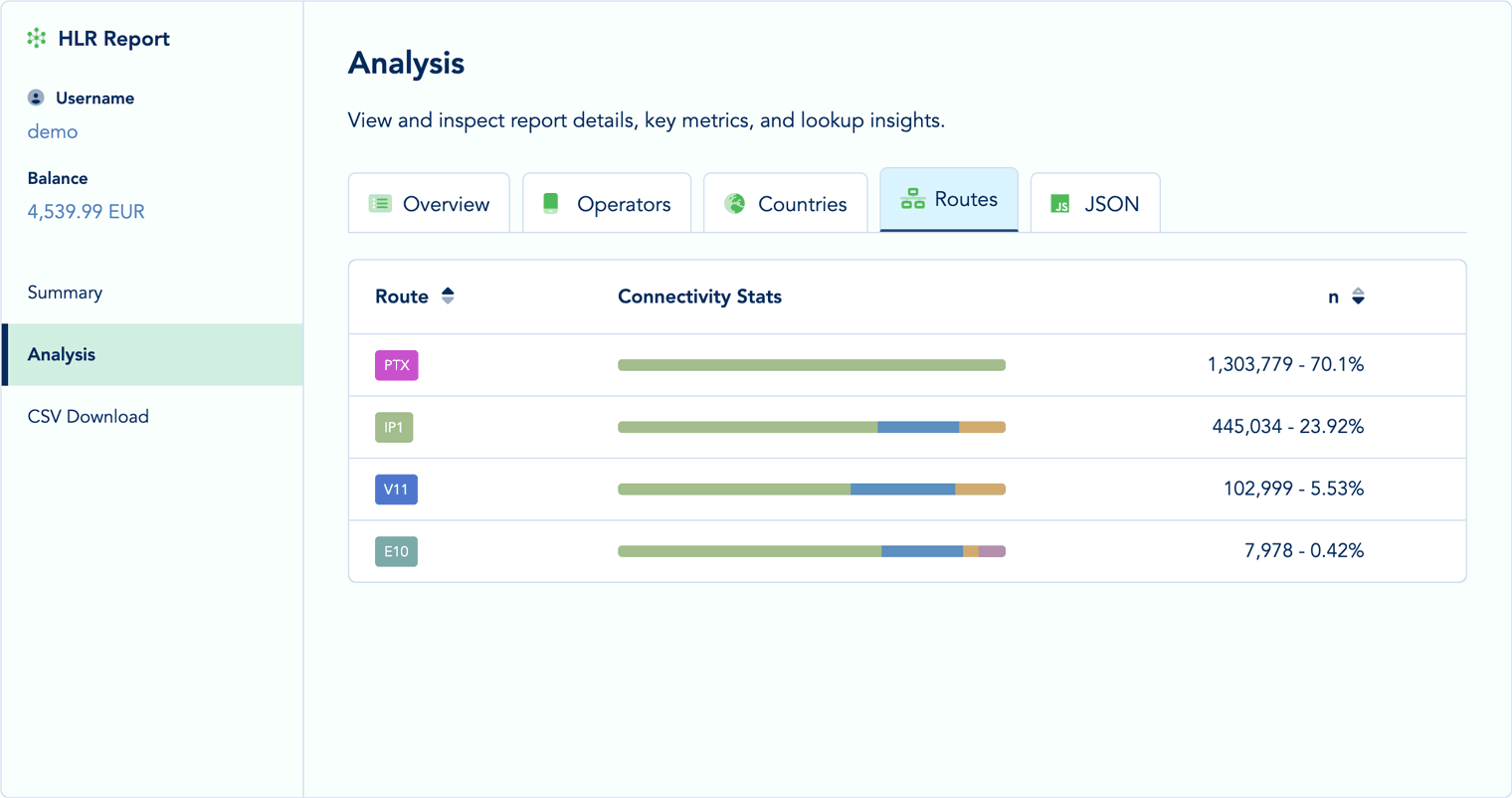

Strategic Routing Intelligence for Maximum Efficiency

Route performance analytics provide comprehensive visibility into how each route performs across critical dimensions including success rates, response latency, data completeness, operator coverage, and cost efficiency. This intelligence powers data-driven routing decisions that optimize for your specific priorities - whether maximizing success rates, minimizing costs, achieving fastest response times, or balancing multiple objectives.

Route Usage Statistics

Track which routes handle your lookup traffic with detailed usage statistics showing lookup counts, percentages of total volume, and temporal distribution patterns. Understanding route usage helps identify opportunities for load balancing, reveals dependencies on specific connections, and guides capacity planning for high-volume operations. The analytics distinguish between explicitly selected routes (specified via API or web interface) versus automatically assigned routes chosen by our intelligent routing algorithms.

Route usage patterns evolve based on availability, performance, and your routing preferences. Monitoring usage trends over time reveals whether route distribution aligns with strategic objectives or whether adjustments are needed to better balance traffic across available connections. For accounts with customized routing maps, usage statistics validate that your configured preferences are correctly applied and producing expected traffic distribution.

Success Rate Analysis by Route

Success rates measure what percentage of lookup attempts complete successfully versus those encountering errors, timeouts, or network failures. Our analytics calculate success rates per route, providing clear visibility into routing reliability and helping identify problematic connections that may require investigation or replacement. Success rate analysis distinguishes between different failure types - routing errors suggest infrastructure problems, while invalid MSISDN errors reflect input data quality rather than route performance.

Premium routes accessing tier-1 networks typically achieve 98-99.5% success rates for properly formatted MSISDNs, while cost-optimized routes may deliver 90-95% success rates due to coverage limitations or reduced infrastructure investment. Understanding these tradeoffs helps make informed decisions about which routes best match your application requirements - mission-critical operations justify premium routing, while bulk validation projects may accept slightly lower success rates to achieve significant cost savings.

Success Rates by Operator & Country

Route performance varies significantly depending on target networks - a route may excel for European operators while underperforming in Asian markets, or deliver excellent results for major carriers while struggling with smaller regional operators. Our analytics break down success rates by operator and country for each route, revealing these nuanced performance characteristics. Use this intelligence to build routing maps that assign traffic to the optimal route based on destination network, ensuring every lookup uses the connection most likely to succeed for that specific target.

Response Time & Latency Metrics

Response time measures how quickly routes return lookup results, directly impacting user experience for real-time applications and throughput capacity for bulk processing operations. Our platform tracks multiple latency metrics including minimum, maximum, average, and percentile response times (p50, p90, p95, p99), providing comprehensive understanding of route performance consistency.

HLR lookup response times typically range from 2-15 seconds depending on route and target network, with variations based on SS7 signaling latency, network congestion, and query complexity. MNP lookups generally respond faster (1-3 seconds) since they access centralized portability databases rather than distributed HLR infrastructure. NT lookups provide the fastest responses (under 1 second) as they query local number plan databases without network signaling.

Latency Distribution Analysis

Beyond average response times, latency distribution reveals performance consistency - routes with narrow distribution deliver predictable performance, while wide distribution indicates variable behavior requiring careful application design. The p95 and p99 metrics show worst-case performance for the vast majority of requests, helping set appropriate timeouts and manage user expectations. Sudden increases in response time percentiles may indicate network congestion, routing path changes, or infrastructure issues requiring investigation.

Data Completeness by Route

Not all routes provide equal data richness - some connections consistently deliver complete HLR data with comprehensive network details and error codes, while others return minimal responses with basic connectivity status only. Data completeness metrics quantify these differences, showing what percentage of successful lookups include each optional data field. Applications requiring specific data elements should prioritize routes with high completeness for those fields, even if it means accepting slightly higher costs or marginally lower success rates.

Advanced Data Availability by Route

Track advanced data field availability percentages per route to identify connections that consistently provide comprehensive network intelligence. Premium routes accessing tier-1 networks deliver rich data sets ideal for applications requiring detailed network assignment and infrastructure information. Standard routes may provide essential connectivity validation while omitting optional advanced fields, making them suitable for basic verification use cases.

Portability Data Provision

Completeness analysis applies to portability information - ensuring routes provide comprehensive original and current network details. For MNP-specific lookups, data completeness measures whether original network information is provided alongside current ported network, enabling full portability analysis versus basic current-operator identification.

Operator Coverage Comparison

Each route maintains relationships with different sets of mobile network operators, resulting in varying coverage footprints across our routing infrastructure. Coverage comparison analytics show which operators are reachable through which routes, identifying connectivity gaps and overlaps that inform routing strategy. For comprehensive global operations, the system automatically recommends route combinations that maximize operator coverage while minimizing redundancy and cost.

Our detailed network coverage analysis provides operator-by-operator routing capabilities, but route performance analytics extend this with usage-based validation - confirming theoretical coverage translates into actual successful lookups. Discrepancies between claimed coverage and actual performance may indicate route configuration issues, operator relationship problems, or outdated coverage information requiring updates.

Cost Efficiency Analysis

Different routes carry different per-lookup costs based on underlying interconnection agreements, network access fees, and service tier positioning. Cost efficiency analysis correlates routing costs with performance metrics, revealing which routes deliver the best value for your specific requirements. The system calculates cost-per-successful-lookup (accounting for failure rates), cost-per-data-field-obtained, and other specialized efficiency metrics tailored to your actual usage patterns.

Optimal routing strategies balance cost against other priorities - minimizing costs absolutely may sacrifice success rates or data completeness, while maximizing quality regardless of expense suits mission-critical applications but wastes resources on routine validation tasks. Our analytics help identify the efficiency frontier where you achieve best results for your budget, flagging opportunities to shift traffic toward routes offering superior cost-performance ratios.

Automated Route Selection Intelligence

When using automatic routing (the default for most accounts), our system selects optimal routes based on real-time performance metrics, destination network, lookup type, and account preferences. The routing algorithm considers success rate history, recent latency measurements, current load distribution, and route-specific operator coverage to make intelligent decisions for every lookup. Route performance analytics provide transparency into automated routing decisions, showing which routes are selected for different scenarios and why certain connections are preferred over alternatives.

The automatic routing system continuously learns from actual results, adapting selections based on observed performance rather than static configurations. If a route's performance degrades, traffic automatically shifts to better-performing alternatives without manual intervention. Analytics dashboards track these automatic adjustments, keeping you informed about routing changes even when you're not actively managing route selection.

Custom Routing Maps & Preferences

Enterprise accounts can configure custom routing maps that specify route preferences based on operator, country, MCCMNC, or other criteria. Route performance analytics validate that custom routing configurations achieve intended results, comparing actual performance against expectations and flagging discrepancies requiring attention. A/B testing functionality allows comparing performance between different routing strategies, providing empirical data to guide optimization efforts.

The system recommends routing map improvements based on performance analysis - for example, suggesting route changes for operators where current selections underperform or identifying opportunities to consolidate traffic onto fewer high-performing routes. Implement these recommendations with confidence, knowing they're driven by actual observed performance in your specific usage context rather than generic best practices.

Route Performance Alerts & Monitoring

Configure alerts that notify you when route performance deviates from expected baselines - for example, success rates dropping below 95%, response times exceeding 10 seconds for more than 5 minutes, or data completeness falling below historical averages. Proactive monitoring ensures route issues are detected quickly, minimizing impact on your operations and enabling rapid response to network problems. Alert history provides a chronological record of route incidents, helping identify recurring problems or patterns that suggest systemic issues requiring deeper investigation.

Comparative Route Benchmarking

Side-by-side route comparison tools enable direct benchmarking across all performance dimensions simultaneously. Generate comparison reports showing how routes stack up against each other for specific operators, countries, or time periods. These benchmarks guide decisions about which routes deserve increased traffic allocation and which should be phased out or used only as fallback options.

Our platform maintains performance baselines for each route based on extensive historical data and network-wide observations. Your account's route performance is compared against these baselines to identify whether you're achieving typical results or experiencing atypical behavior that may indicate configuration issues or eligibility for specialized routing options.

Future-Proof Route Planning

Route performance trends reveal how connections evolve over time - improving with infrastructure investments, degrading due to network issues, or remaining stable with consistent characteristics. Use trend analysis to anticipate future performance, identify routes on upward trajectories deserving increased utilization, and detect declining routes requiring preemptive traffic migration before quality becomes unacceptable. As new routes become available, performance analytics provide fair comparison against established connections, helping you decide when new options merit adoption versus when existing routes remain superior.

Reports, Exports & Data Integration

Transform Analytics into Actionable Deliverables

While our interactive dashboards provide powerful real-time analytics, many workflows require exporting data for offline analysis, integration with external systems, or sharing with stakeholders who need results without platform access. Our comprehensive export capabilities deliver lookup results and analytics in multiple formats - CSV for spreadsheet analysis, JSON for programmatic integration, and visual reports for presentation and documentation. Every export maintains complete data fidelity, ensuring downstream applications receive the same rich intelligence available through our web interface.

Interactive Report Views

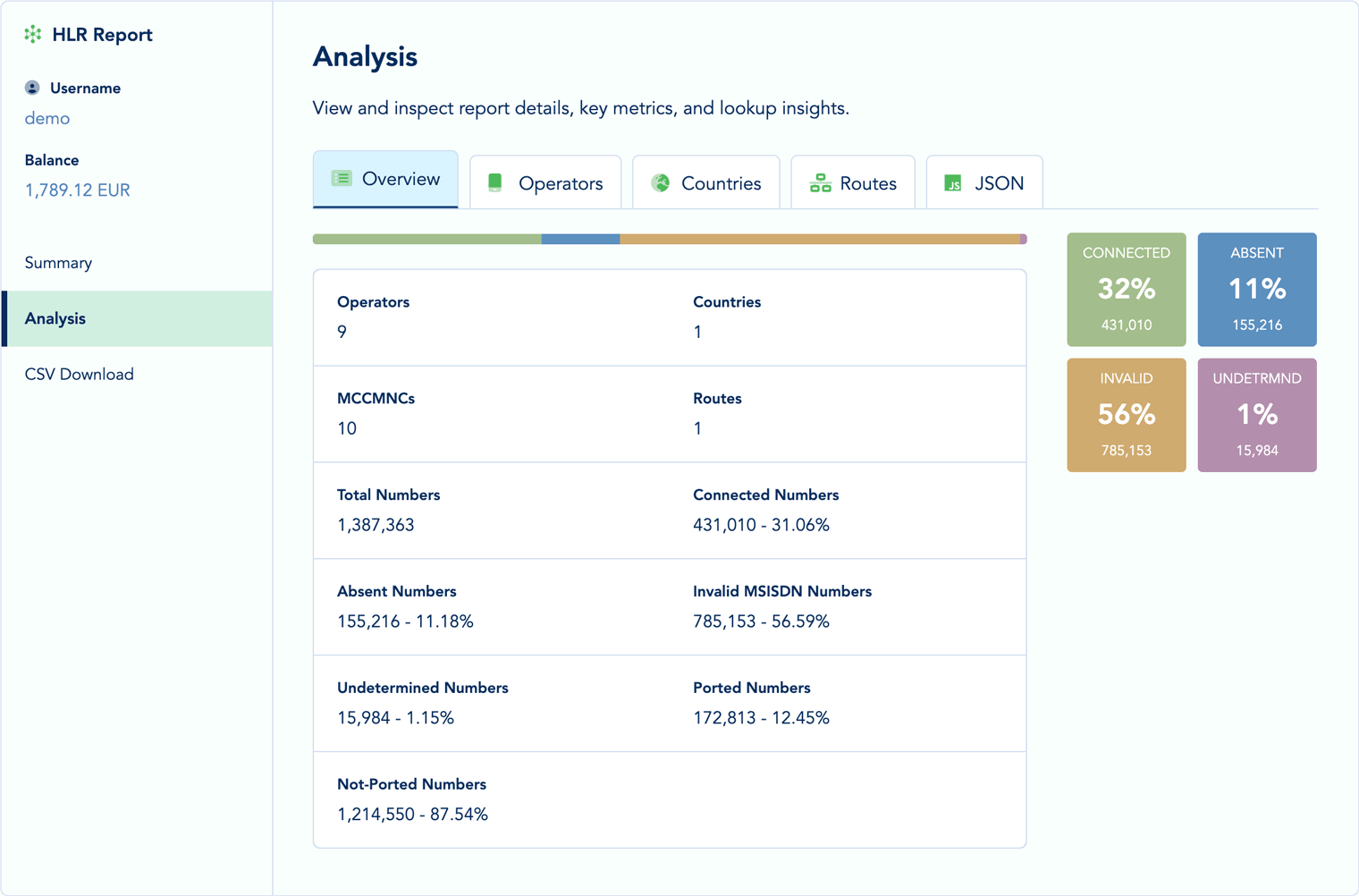

Before exporting, explore your data through our interactive report views that organize results across multiple analytical dimensions. The report interface provides tabbed navigation between overview summaries, operator-level breakdowns, country analyses, and route performance metrics. Each view includes visual connectivity meters showing status distributions, sortable tables for detailed exploration, and one-click drill-down into granular details. Experience these interactive reports with our examples: HLR Report, MNP Report, and NT Report.

Overview Tab

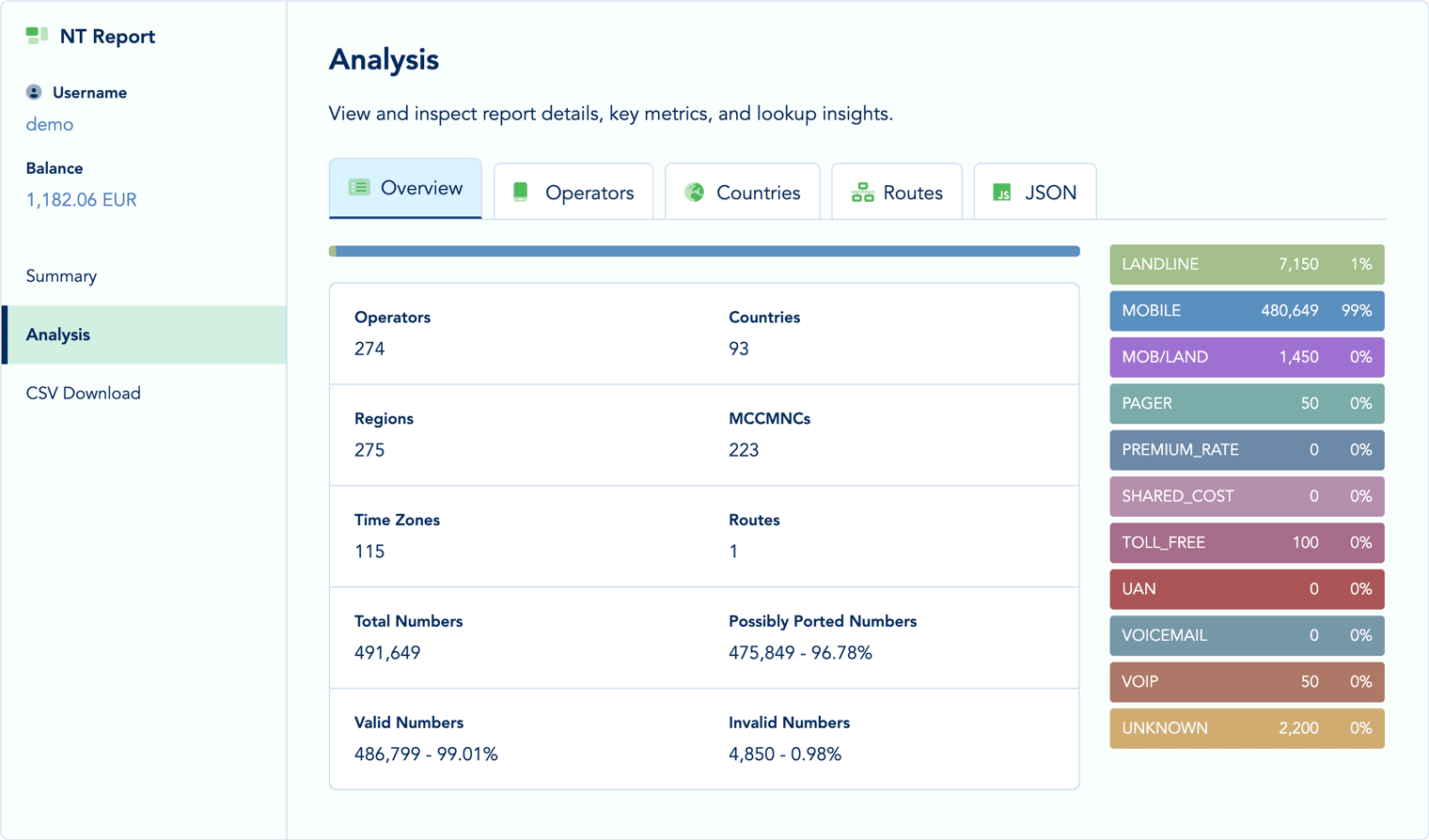

The overview provides high-level summary statistics including total lookup count, unique operators identified, countries covered, routes utilized, and aggregate connectivity status distribution. For HLR reports, overview metrics highlight connected/absent/invalid/undetermined percentages with visual representation. MNP overviews emphasize portability rates showing ported versus native distribution. NT overviews break down number type classifications across mobile, landline, VoIP, and special service categories. This at-a-glance summary helps quickly assess report quality and identify key patterns before deeper analysis.

Operators Tab

The operators tab lists every mobile network operator identified during lookups, sorted by count with highest-volume operators at the top. Each operator row displays the network name, MCCMNC code, country, connectivity status distribution (for HLR), and absolute/percentage lookup counts. Click any operator to open detailed analysis showing that operator's complete performance profile including success rates, data completeness, and comparison against other operators in the same country. Export operator-specific subsets to create targeted reports for specific networks or conduct competitive analysis across carriers.

Countries Tab

Geographic analysis through the countries tab reveals how lookups distribute across nations and regions. Each country entry shows total counts, unique operators present, connectivity metrics, and flags any unusual patterns requiring attention. Compare connectivity performance between countries to identify geographic quality variations or validate that international audiences exhibit expected behaviors. Country-level filtering enables regional report generation - extract European lookups separately from Asian or American results for region-specific analysis.

Routes Tab

The routes tab shows which network connections processed your lookups, with performance metrics for each route including success rates, average response times, and data completeness indicators. This visibility helps validate that routing preferences are correctly applied and achieving desired results. Route-specific exports support troubleshooting by isolating results from particular connections, enabling direct comparison between routing options.

CSV Export Capabilities

CSV (Comma-Separated Values) exports deliver complete lookup results in a universally compatible format ideal for spreadsheet applications, database imports, and data processing pipelines. Our CSV exports include comprehensive field sets covering all available data points - MSISDN, connectivity status, operator details, MCCMNC, country information, network assignment data, portability flags, timestamps, costs, routes, and processing metadata.

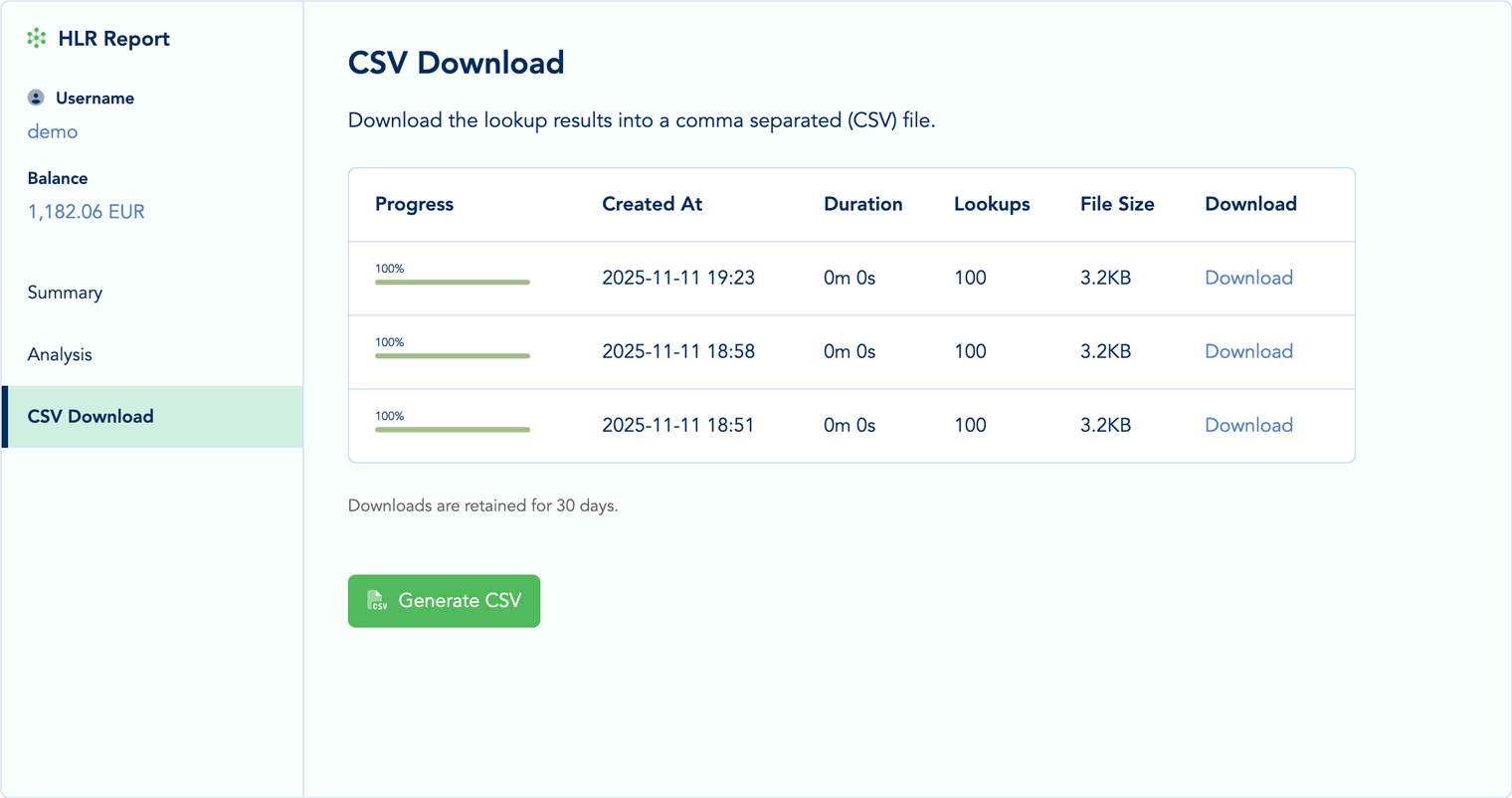

CSV Generation & Download

Generate CSV exports on-demand from any report, regardless of size - the system handles jobs containing millions of lookups by processing exports asynchronously in the background. Large exports are automatically split into manageable file segments (typically 100,000-500,000 rows per file) to ensure compatibility with spreadsheet applications that have row limits. Receive notifications when CSV generation completes, with download links that remain active for 30 days allowing retrieval at your convenience.

The CSV export interface shows generation progress with real-time updates indicating rows processed and estimated completion time. Multiple CSV exports can be queued simultaneously - generate separate reports for different date ranges, storages, or filtered subsets without waiting for each to complete. Downloaded CSV files are compressed (ZIP format) to reduce file sizes and accelerate downloads, with compression ratios typically achieving 60-80% size reduction.

Customizable Field Selection

Choose which fields to include in CSV exports, creating customized datasets tailored to specific analysis requirements or downstream system expectations. Exclude unnecessary columns to reduce file sizes and simplify data processing - for example, basic validation workflows may only need MSISDN and connectivity status, omitting advanced network detail fields. Save field selection presets for frequently used configurations, enabling one-click export generation with consistent column layouts.

Character Encoding & Formatting

CSV exports support multiple character encodings (UTF-8, Latin-1, Windows-1252) and regional formatting conventions (date formats, decimal separators, quote styles) to ensure compatibility with various analysis tools and geographic preferences. Select appropriate encoding based on target application requirements - UTF-8 for maximum Unicode compatibility, or platform-specific encodings for optimal Excel integration. Headers can be customized with human-readable labels or technical field names depending on intended audience and usage context.

JSON Data Exports

JSON (JavaScript Object Notation) exports provide structured data ideal for programmatic integration, API consumption, and modern data processing pipelines. The JSON format preserves data types, supports nested structures, and maintains complete field relationships without the ambiguities sometimes introduced by flat CSV representations. Use JSON exports to feed lookup results into business intelligence platforms, data warehouses, custom analytics applications, or automated workflow systems.

Complete vs Summary JSON

Complete JSON exports include every lookup result as individual objects with full attribute sets - ideal when downstream systems need to process each lookup independently. Summary JSON exports aggregate results into analytical structures matching our dashboard views - operator summaries, country breakdowns, connectivity distributions, and calculated metrics. Choose the appropriate JSON format based on integration requirements - complete for record-by-record processing, summary for dashboard replication or metric extraction.

Real-Time JSON via API

Beyond static JSON exports, retrieve analytics data in real-time through our REST API endpoints. API responses deliver immediate JSON without requiring export generation or download steps - perfect for live integrations that display analytics within external applications. Programmatically query reports by storage identifier, date range, or custom filters, receiving JSON responses containing precisely the data segment needed. Rate limits are generous (hundreds of requests per minute), supporting frequent polling or real-time display scenarios without throttling concerns.

Visual Report Generation

Generate visual reports capturing dashboard analytics as presentation-ready documents suitable for stakeholder sharing, documentation, or archival purposes. Visual reports include connectivity meters, distribution charts, operator tables, and summary statistics formatted for readability without requiring platform access. These reports serve as standalone artifacts documenting lookup campaign results, validation exercises, or routine monitoring activities.

Report Customization Options

Customize visual reports with your branding elements, descriptive titles, explanatory notes, and selective section inclusion. Add context paragraphs explaining what the report represents, why lookups were performed, and how results should be interpreted. Include or exclude specific sections based on audience - executive summaries emphasize high-level metrics, while technical reports provide comprehensive details including route performance and error analysis.

Scheduled & Automated Exports

Configure scheduled exports that automatically generate and deliver reports on recurring schedules - daily, weekly, monthly, or custom intervals. Automated exports eliminate manual repetition, ensuring stakeholders receive timely updates without requiring platform interaction. Schedule parameters specify storage identifiers, date ranges relative to execution time (e.g., 'previous 7 days'), export formats, and delivery destinations.

Delivery options include email attachments, SFTP upload to designated servers, webhook POST with export URLs, or direct integration with cloud storage services (S3, Azure Blob Storage, Google Cloud Storage). Failed exports trigger automatic retries with exponential backoff, while persistent failures generate alert notifications enabling rapid troubleshooting.

Export History & Management

Maintain complete history of generated exports with searchable archives showing export dates, formats, record counts, file sizes, and download status. Regenerate past exports on-demand by re-running historical export configurations - useful when original files are lost or when format requirements change necessitating re-export with different settings. Archive retention policies automatically clean up old exports after configurable periods (default 30-90 days), with options to permanently preserve specific exports for compliance or long-term reference.

Data Filtering & Subsetting

Apply filters before export generation to create focused datasets containing only relevant records. Filter by connectivity status to export only connected numbers or isolate invalid MSISDNs for removal from databases. Filter by operator, country, or route to analyze specific network segments or validate routing decisions for particular targets. Combine multiple filter criteria with boolean logic (AND/OR) to create precise queries - for example, 'connected numbers on Operator X in Country Y processed via Route Z'.

Saved filters can be reused across multiple exports, maintaining consistent selection criteria for recurring analysis workflows. The system previews filter impact before export generation, showing how many records match criteria and providing sample results to validate filter accuracy.

Integration with Business Intelligence Platforms

Connect our analytics directly to leading business intelligence platforms including Tableau, Power BI, Looker, and Qlik through standard connectors and API integrations. Pre-built connector configurations streamline setup, with documented field mappings and optimal query patterns for each platform. Scheduled exports can automatically populate data warehouse tables, enabling BI platforms to refresh dashboards on regular cadences without manual intervention.

For custom BI implementations, comprehensive API documentation and example code (Python, JavaScript, Ruby, PHP) demonstrate best practices for data extraction, transformation, and loading. Our support team assists with integration planning, helping design efficient data pipelines that minimize API calls while maintaining data freshness.

Compliance & Audit Exports

Regulatory requirements or internal policies may mandate comprehensive record retention and audit capability for telecommunications operations. Our export system supports compliance workflows by providing complete, immutable records of lookup activities including timestamps, processing details, network responses, and costs. Generate audit-ready exports with certified timestamps and optional cryptographic signatures proving data authenticity and integrity.

Compliance exports can include additional context such as user identities, API keys used, source IP addresses, and request/response headers - all information necessary for thorough auditing without compromising operational security. Long-term archive options ensure exports remain accessible for years (5+ years) to satisfy regulatory retention requirements even as platform storage policies evolve.

Storage Management & Organization

Intelligent Data Organization for Multi-Project Operations

Storages transform how you organize, analyze, and manage HLR, MNP, and NT lookup results across multiple projects, clients, campaigns, or operational contexts. Think of storages as intelligent cloud-based folders that automatically aggregate analytics for their contained lookups, enabling isolated analysis without cross-contamination between unrelated datasets. Whether you're managing lookups for dozens of clients, running parallel marketing campaigns, or conducting multi-phase validation studies, storages provide the structure needed to maintain clarity and control.

The Storage Concept

Every lookup can be assigned to a named storage at submission time - either through explicit specification via the web interface or API, or through automatic assignment based on date-based default storage creation. Once assigned, lookups remain permanently associated with their storage, with all subsequent analytics, reports, and exports scoped to that storage's boundary. This isolation ensures that client A's lookups never affect client B's analytics, campaign metrics remain segregated by project, and validation exercises can be analyzed independently from production traffic.

Storages aren't just organizational labels - they're first-class data entities with their own metadata, access controls, retention policies, and analytical state. Each storage maintains aggregate statistics computed incrementally as lookups are added, providing instant access to summary metrics without requiring full dataset scans. This architecture enables sub-second query response times even for storages containing millions of lookups, making real-time analytics practical at any scale.

Storage Naming & Organization Strategies

Effective storage naming creates intuitive organization that scales as your operations grow. Common strategies include client-based naming (CLIENT-NAME-HLR-2025-01), campaign identifiers (CAMPAIGN-ID-VALIDATION), project codes (PROJECT-ALPHA-PHASE-2), or functional purposes (DAILY-DATABASE-CLEANING). The system automatically appends timestamps to storage names, creating time-series organization that simplifies longitudinal analysis and historical comparisons.

Client-Based Organization

Service providers managing lookups for multiple clients use storage-per-client organization to maintain strict data segregation. Each client receives dedicated storage space where their lookups accumulate, with access controls ensuring clients can only view their own data. Generate client-specific reports directly from storages without manual filtering or data subset extraction - the storage boundary automatically defines the analysis scope. Billing and accounting benefit from storage isolation, as each storage tracks its own lookup counts and costs enabling straightforward client invoicing.

Campaign-Based Organization